- Home

- Wearables

- Wearables Features

- Where Apple Leads, Payment Wristbands Ready to Tap 'Wearables' Boom

Where Apple Leads, Payment Wristbands Ready to Tap 'Wearables' Boom

Watches, wristbands, jewellery, key fobs and other so-called wearables, as well as mobile phones, are expected to follow a surge in tap-and-go payments in countries where card issuers, banks, retailers and consumers have embraced the technology.

Some 75 million wearable products are expected to be shipped this year by people looking at alternatives to tapping a card on a merchant's terminal, almost treble the 29 million shipped last year, according to technology research firm CCS Insight.

"People want to tell their payment provider how they want to pay and not be told in the traditional way of 'here's your plastic, now get on with it'," said Howard Berg, senior vice president at Gemalto.

Gemalto is a digital security firm best known for making SIM cards which issued its first payment wristband last year and expects to distribute hundreds of thousands in Britain alone this year.

CCS Insight predicts the spike in wearables this year will be followed by shipments more than doubling again by 2018 to leave more than 340 million wearable devices in use. Most will be smartwatches and wristbands, though payments will also be made via wearable cameras, jewellery, tokens and eyewear.

"Payments is a really key element in the direction of technology at the moment. There are lots of companies trying to crack this nut, and the key is it needs to be secure and easy," said Ben Wood, analyst at CCS.

Apple effect

So far, much of the shake-up in payments has been in how transactions are processed, far out of the sight of customers.

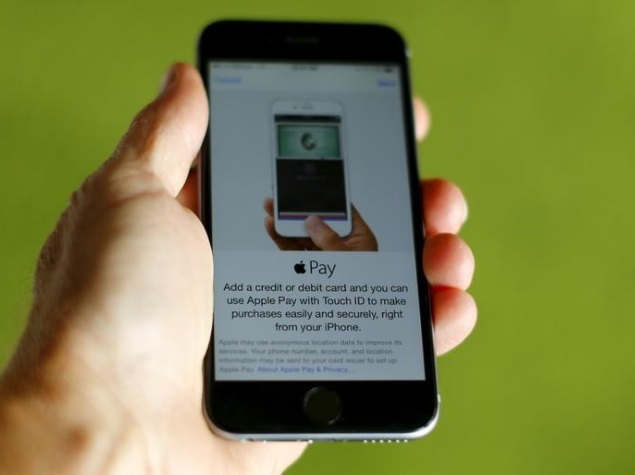

But the rollout of Apple Pay in the United States in October and in Britain this week has thrust the way consumers pay into the spotlight.

The "Apple effect" can often help rivals too, and some expect the launch to mark a tipping point for contactless payments.

Banks could offer a range of options.

BPay, launched last month by Barclays' credit card division, is offering users options to put a payment device on a wristband, a key fob or a sticker that can attach to a device such as mobile phone, though it is charging for each one.

Growth in wearables is likely to be led by countries where contactless payments have already taken off, given they use the same terminals. Some European and Asian countries look set to lead.

MasterCard said contactless card growth is running at 70 percent a year, and Australia is leading the way with 69 percent of transactions there now contactless.

Visa Europe said its cardholders spent EUR 1.6 billion (roughly Rs. 10,789 crores) using contactless payments in March, a threefold increase on a year earlier led by users in Britain, Czech Republic, France, Poland and Spain.

Frictionless

One in 10 contactless payments in Britain is on London's transport system, where 625,000 tap-and-go payments are made daily, not counting prepaid Oyster cards.

Wearables will range from high-end watches costing more than $1,000 to throwaway wristbands made for less than $3.

Wristbands could increasingly displace cards on buses and at underground stations where people may prefer not to take out a wallet or phone. They are also taking off as digital wallets at festivals, holiday resorts and sports events. Disney, for example, launched MagicBands for its parks in late 2013.

"It's a very socially accepted place to wear something and therefore it's a very good place to put a payment mechanism, it's almost a frictionless payment," CCS's Wood said.

Because most contactless devices or cards can be used by anyone if they are lost or stolen, many countries cap the amount per transaction.

While consumers may benefit from ease of use, banks, merchants and venues also stand to benefit as there is evidence more is typically spent with wristbands than cards, while they could also get access to valuable data on customer behaviour.

Banks are also on the lookout for brand benefits from teaming up with popular teams for their wearables.

Spain's Caixabank, which distributed 30,000 wristbands last year, is offering ones with FC Barcelona branding this year - though the Barcelona-based bank is yet to offer them in the colours of arch-rivals Real Madrid.

© Thomson Reuters 2015

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)