- Home

- Telecom

- Telecom News

- Vodafone gets FIPB approval to raise stake in Indian venture to 100 percent

Vodafone gets FIPB approval to raise stake in Indian venture to 100 percent

Vodafone's Rs. 10,141 crores Foreign Direct Investment (FDI) proposal has been cleared, sources said after the meeting of FIPB in New Delhi.

(Also see: FIBP to decide on Vodafone, SingTel FDI proposals on Monday)

The telecom major, which holds a 64.38 percent stake in the Indian unit, will buy the remaining outstanding shares from minority shareholders like Ajay Piramal and Analjit Singh.

Piramal holds an 10.97 percent stake in India's second-largest telecom company by subscribers, while Singh, who is Vodafone India's non-executive chairman, holds 24.65 percent.

Vodafone Group Plc will pay Analjit Singh Rs. 1,241 crores and Piramal Enterprises Rs. 8,900 crores for their stakes in Vodafone India as part of a proposal.

CGP India Investments Ltd, an indirect Mauritian subsidiary of Vodafone International Holdings BV, had sought FIPB approval to buy the stake held by minority shareholders in Vodafone India Ltd.

The decision on the Vodafone application was deferred at the previous meeting as comments from the Ministry of Home Affairs were awaited.

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Lava Bold N2

- Vivo V60 Lite 4G

- Tecno Pova Curve 2 5G

- Lava Yuva Star 3

- Honor X6d

- OPPO K14x 5G

- Samsung Galaxy F70e 5G

- iQOO 15 Ultra

- Asus Vivobook 16 (M1605NAQ)

- Asus Vivobook 15 (2026)

- Brave Ark 2-in-1

- Black Shark Gaming Tablet

- boAt Chrome Iris

- HMD Watch P1

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

-

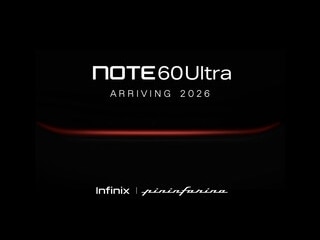

Infinix Note 60 Ultra Battery Details Revealed by US FCC Listing; Leaked Renders Hint at Secondary Display

Infinix Note 60 Ultra Battery Details Revealed by US FCC Listing; Leaked Renders Hint at Secondary Display

-

Android XR OS Reportedly Leaks in Early Screenshots; to Offer Clean Spatial Interface, ‘Glimmer’ Design

Android XR OS Reportedly Leaks in Early Screenshots; to Offer Clean Spatial Interface, ‘Glimmer’ Design

-

iOS 26.4 Beta 1: Apple Music Gets New AI-Powered Playlist Playground Feature

iOS 26.4 Beta 1: Apple Music Gets New AI-Powered Playlist Playground Feature

-

India AI Summit: Anthropic, Infosys Announce Partnership to Bring Agentic AI Solutions for Enterprises

India AI Summit: Anthropic, Infosys Announce Partnership to Bring Agentic AI Solutions for Enterprises

![[Partner Content] OPPO Reno15 Series: AI Portrait Camera, Popout and First Compact Reno](https://www.gadgets360.com/static/mobile/images/spacer.png)