- Home

- Telecom

- Telecom News

- Intelsat Expects $14 Billion OneWeb Merger Deal to Fail

Intelsat Expects $14 Billion OneWeb Merger Deal to Fail

Satellite operator Intelsat SA said it expected its $14 billion merger with peer OneWeb Ltd, which is backed by Japan's SoftBank Group Corp, to fall through as it failed to get enough of its creditors to back the deal.

The US satellite startup and debt-laden Intelsat had agreed to merge in a share-for-share deal in February.

SoftBank in February also offered to buy voting and non-voting shares in the combined company for $1.7 billion (roughly Rs. 10,980 crores) in cash and take a 39.9 percent voting stake.

The merger and SoftBank's investment were both conditional on approval from Intelsat's bondholders.

Intelsat said on Thursday it had terminated a series of debt swap offers tied to the deal as its creditors did not accept the terms by May 31 deadline.

"There were many stakeholders' interests that needed to be satisfied in this complex transaction," Intelsat Chief Executive Stephen Spengler said in a statement.

Reuters had reported on Wednesday that SoftBank would let the merger drop.

Intelsat's shares had fallen nearly 48 percent since the merger was announced in February.

© Thomson Reuters 2017

Catch the latest from the Consumer Electronics Show on Gadgets 360, at our CES 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- iQOO Z11 Turbo

- OPPO A6c

- Samsung Galaxy A07 5G

- Vivo Y500i

- OnePlus Turbo 6V

- OnePlus Turbo 6

- Itel Zeno 20 Max

- OPPO Reno 15 Pro Mini 5G

- Lenovo Yoga Slim 7x (2025)

- Lenovo Yoga Slim 7a

- Realme Pad 3

- OPPO Pad Air 5

- Garmin Quatix 8 Pro

- NoiseFit Pro 6R

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

-

Realme 16 5G Specifications Leak via Retailer Listing; to Feature Dimensity 6400 Chipset

Realme 16 5G Specifications Leak via Retailer Listing; to Feature Dimensity 6400 Chipset

-

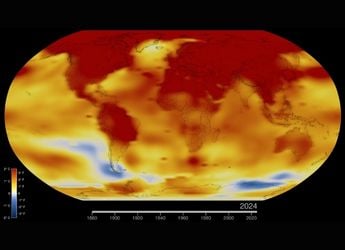

NASA Says the Year 2025 Almost Became Earth's Hottest Recorded Year Ever

NASA Says the Year 2025 Almost Became Earth's Hottest Recorded Year Ever

-

Wicked: For Good OTT Release: Know When, Where to Watch the Musical Fantasy

Wicked: For Good OTT Release: Know When, Where to Watch the Musical Fantasy

-

Paul McCartney: Man on the Run OTT Release: When, Where to Watch the Biographical Music Documentary

Paul McCartney: Man on the Run OTT Release: When, Where to Watch the Biographical Music Documentary