- Home

- Social networking

- Social networking News

- LinkedIn defies social media slump

LinkedIn defies social media slump

"Another fantastic quarter," said Rick Summer, analyst with Morningstar. "This is a company that continues to execute quite well with surprising visibility into demand."

Shares of the company rose about 6 percent in after-market trade after closing at $93.51 on the New York Stock Exchange on Thursday.

LinkedIn's results come as investors shed their holdings in once white hot consumer Internet companies such as Facebook, Groupon and Zynga.

Second-quarter revenue rose 89 percent to $228.2 million, beating analysts' average forecast of $216.3 million, according to Thomson Reuters I/B/E/S.

LinkedIn also raised its full-year revenue forecast to a range of $915 million to $925 million from $880 million to $900 million.

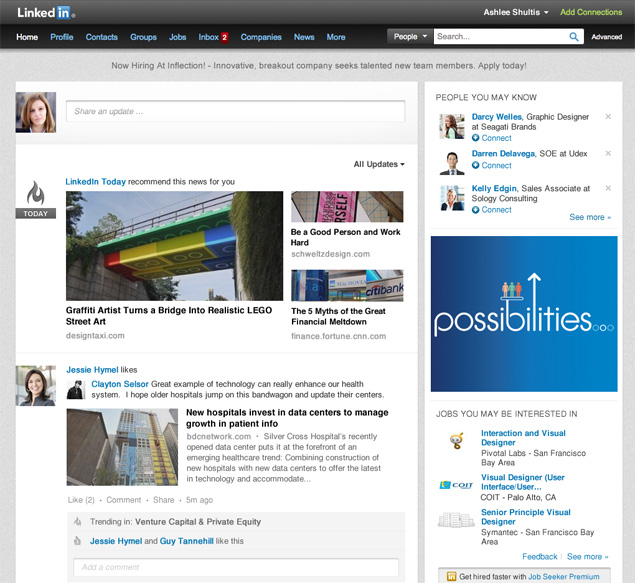

LinkedIn connects professionals seeking jobs and companies looking for employees, setting it apart from other social media companies.

"LinkedIn has a distinct value advantage. They own an identity in the professional user," said Summer.

"They have different ways to monetize the user. That is a distinct advantage to how investors are receiving the stock."

LinkedIn was one of the first prominent U.S. social networking sites to execute an initial public offering that smashed expectations shares are trading at more than double their IPO price of $45.

Conversely, Facebook Inc made its public debut one of the most highly anticipated in technology and Internet circles in years to dismal results. Facebook shares hit a low of $19.91 on Thursday, losing almost half of their value since the company's IPO at $38 in May.

LinkedIn and Facebook are often held up as illustrations of a new breed of Internet companies that have been quickly embraced by people for the ease of connecting to others.

But the similarities end there. Facebook largely depends on advertising revenue and there are concerns that it cannot maintain its blistering pace of growth. The company reported a 32 percent increase in revenue for the second quarter, compared with the more than 100 percent growth it delivered at the same time last year.

LinkedIn, though, is business-oriented and mines three different veins of revenue: subscriptions to its premium service, advertising and companies that use LinkedIn for hiring.

Revenue from its hiring solutions, which makes up more than half of total revenue, rose 107 percent to $121.6 million.

The Mountain View, California-based company did hit one hurdle in the quarter the theft of millions of its members' passwords in June.

On a call with analysts, LinkedIn Chief Executive Jeff Weiner pointed to the company's member growth to 175 million users from about 161 million in the first quarter as proof the security breach did not dent the LinkedIn's reputation.

The company did say it was taking steps to update its security and will have an additional $2 million to $3 million in expenses during the second half of the year.

LinkedIn posted net income of $2.8 million, compared with $4.5 million for the same period a year ago.

Its non-GAAP earnings of 16 cents per share were in-line with analysts' expectations.

Copyright Thomson Reuters 2012

For details of the latest launches and news from Samsung, Xiaomi, Realme, OnePlus, Oppo and other companies at the Mobile World Congress in Barcelona, visit our MWC 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Apple iPhone 17e

- AI+ Pulse 2

- Motorola Razr Fold

- Honor Magic V6

- Leica Leitzphone

- Samsung Galaxy S26+

- Samsung Galaxy S26 Ultra

- Samsung Galaxy S26

- MacBook Pro 16-Inch (M5 Max, 2026)

- MacBook Pro 16-Inch (M5 Pro, 2026)

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Apple iPad Air 13-Inch (2026) Wi-Fi

- Huawei Watch GT Runner 2

- Amazfit Active 3 Premium

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)