- Home

- Social networking

- Social networking News

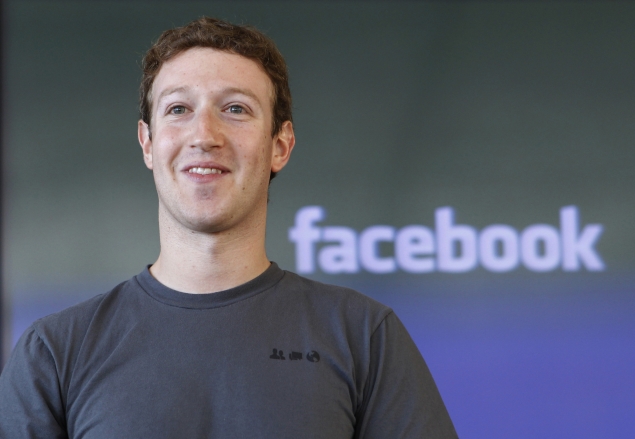

- Facebook's Zuckerberg the new mobile king

Facebook's Zuckerberg the new mobile king

The keynote speaker on the opening day of the February 24-27 Mobile World Congress in Barcelona, Spain, Zuckerberg has come a long way in the mobile world in a short time.

When Facebook sold its shares to the public in an initial public offering in May 2012, "it literally had no mobile advertising revenues," said Eden Zoller, analyst at the research house Ovum.

"It did actually have a pretty strong mobile user base at IPO but what it had failed to do at that time was actually monetise those mobile users," she said.

At the time of the float, worries over the lack of money coming in from the mobile business sent Facebook's shares sliding.

But the social network - boasting more than 1.2 billion members - quickly repaired its strategy.

By the end of 2013, mobile devices accounted for 53 percent of Facebook's advertising revenue, bringing in $1.2 billion in the last quarter and more than $3 billion over the whole year.

However mobile advertising can be "highly intrusive", Zoller cautioned, especially if it interrupts a user's engagement with an application.

"You have to be very careful."

Nevertheless, the social network needs to keep up the momentum, the analyst said.

"It can't be complacent. On the mobile front it is particularly important. Consumers have an increasing number of social media and social messaging alternatives to Facebook."

The company still has a weak point, however, she added: its failure to carve out a strong position in mobile payment systems, which are expected to show strong growth in the next few years.

Nonetheless, Facebook is clearly building a base for further revenue growth.

On Wednesday, the social network announced its takeover of WhatsApp, which followed last year's smaller purchase of online photograph-sharing site Instagram.

Half a billion users on WhatsApp

"Facebook is paying for one of the fastest growing audiences in history -- WhatsApp is now nearing half a billion users globally -- and the monetisation potential that that brings," said Guillermo Escofet of research house Informa.

Facebook has captured 18.4 percent of the mobile publicity market, making it the number two force after Google, according to digital media analysts eMarketer.

"They performed a remarkable turnaround from about two years ago," said Escofet, recalling the social network's early reluctance to push advertising to mobile devices.

"The reason for that is because they did not want to compromise the user experience on mobile and they did not want to cram the small mobile screen with ads," he said.

Facebook's solution was to integrate advertising into its users' news stream, where members read the latest events in their "friends"' lives.

It has proven an efficient strategy. Of Facebook's 1.23 billion users who are active at least once a month, three-quarters access the site from their smartphones.

Today, it is a "mobile company", declared Sephi Shapira, chief executive of advertising platform MassiveImpact, a Facebook partner.

"We are very happy with them," he said.

MassiveImpact's clients publicise on Facebook but only pay when a user clicks on the advertisement and then actually buys the product.

For products such as insurance, the percentage of users who make a purchase after clicking on a web advertisement is often in single digits, but for mobile apps that figure can rise to 20 or 30 percent.

"For app promotion, I think they're definitely the best," Shapira said.

Many advertisers now devote all their publicity to mobile devices, not even spending on Internet advertising, he said.

But "I think we should not get too excited," Shapira cautioned.

"You have to run just to stay alive. So in this market, you have to constantly be innovating and developing new technologies just to survive, if you don't, you disappear."MWC 2014 in pictures

Catch the latest from the Consumer Electronics Show on Gadgets 360, at our CES 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Red Magic 11 Air

- Honor Magic 8 RSR Porsche Design

- Honor Magic 8 Pro Air

- Infinix Note Edge

- Lava Blaze Duo 3

- Tecno Spark Go 3

- iQOO Z11 Turbo

- OPPO A6c

- Lenovo Yoga Slim 7x (2025)

- Lenovo Yoga Slim 7a

- Lenovo Idea Tab Plus

- Realme Pad 3

- Moto Watch

- Garmin Quatix 8 Pro

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

![[Sponsored] Haier C90 OLED TV | Dolby Vision IQ, 144Hz OLED and Google TV in Action](https://www.gadgets360.com/static/mobile/images/spacer.png)