- Home

- Social networking

- Social networking News

- Facebook's lasting legacy a new generation of tech tycoons

Facebook's lasting legacy - a new generation of tech tycoons

By Somini Sengupta, The New York Times | Updated: 5 June 2012 00:31 IST

Click Here to Add Gadgets360 As A Trusted Source

Advertisement

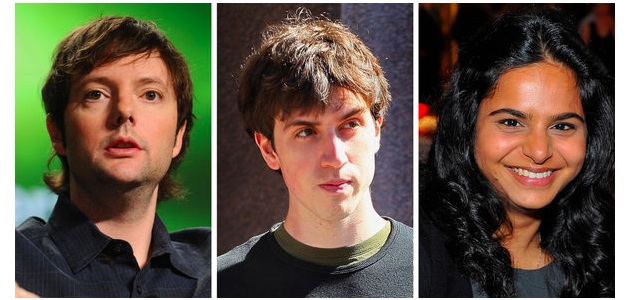

Matt Cohler was employee No. 7 at Facebook. Adam D'Angelo joined his high school friend Mark Zuckerberg's quirky little start-up in 2004 - and became its chief technology officer. Ruchi Sanghvi was the first woman on its engineering team.

All have left Facebook. None are retiring. With lucrative shares and a web of valuable industry contacts, they have left to either create their own companies, or bankroll their friends.

With Facebook's public offering in mid-May, more will probably join their ranks in what could be one of Facebook's lasting legacies - a new generation of tech tycoons looking to create or invest in, well, the next Facebook.

"The history of Silicon Valley has always been one generation of companies gives birth to great companies that follow," said Mr. Cohler, who, at 35, is now a partner at Benchmark Capital, and an investor in several start-ups created by his old friends from Facebook. "People who learned at one set of companies often go on to start new companies on their own."

"The very best companies, like Facebook," he continued, "end up being places where people who come there really learn to build things."

This is the story line of Silicon Valley, from Apple to Netscape to PayPal and now, to Facebook. Every public offering creates a new circle of tech magnates with money to invest. This one, though, with a jaw-dropping $100 billion valuation, will create a far richer fraternity.

Its members will be, by and large, young men, mostly white and Asian who, if nothing else, understand the value of social networks. And they have the money. Some early executives at Facebook have already sold their shares on the private market and have millions of dollars at their disposal.

Mr. Cohler, for example, is at the center of a complex web of business and social connections stemming from Facebook.

In 2002, barely two years out of Yale, he was at a party where he met Reid Hoffman, a former PayPal executive who was part of a slightly older social circle. The two men "hit it off," as Mr. Cohler recalled on the online question-and-answer platform, Quora (which was co-founded by Mr. D'Angelo). He became Mr. Hoffman's protege, assisting him with his entrepreneurial investments, and following him to his new start-up, LinkedIn.

Then, Mr. Cohler joined a company that Mr. Hoffman and several other ex-PayPal executives were backing: Facebook.

Mr. Cohler stayed at Facebook from 2005 to 2008, as it went from being a college site to a mainstream social network. One of his responsibilities was to recruit the best talent he could find, including from other companies.

Mr. Cohler left the company to retool himself into a venture capitalist. He has since been valuable to his old friends from Facebook.

Through his venture firm, Mr. Cohler has raised money for several companies founded by Facebook alumni, including Quora, created in 2010 by Mr. D'Angelo and another early Facebook engineer, Charlie Cheever. Other companies include Asana, which provides software for work management and was created in 2009 by Dustin Moskovitz, a Facebook co-founder; and Peixe Urbano, a Brazilian commerce Web site conceived by Julio Vasconcellos, who managed Facebook's Brazil office in Sao Paulo.

Mr. Cohler has put his own money into Path, a photo-sharing application formed in 2010 by yet another former Facebook colleague, Dave Morin. Path is also bankrolled by one of Facebook's venture backers: Greylock Partners, where Mr. Hoffman is a partner.

And he has invested in Instagram, which was scooped up by Facebook itself for a spectacular $1 billion. "Thrilled to see two companies near and dear to my heart joining forces!" Mr. Cohler posted on Twitter after the acquisition.

Instagram clearly was a good bet; it is impossible to say whether any of the other investments Mr. Cohler or other Facebookers are making will catch fire or whether the start-ups they found will last. Certainly, there is so much money in the Valley today that start-ups have room to grow without even a notion of turning a profit.

Ms. Sanghvi, one of the company's first 20 employees, married a fellow Facebook engineer, Aditya Agarwal. Mr. Zuckerberg attended their wedding in Goa, India.

With her husband and a third engineer from Facebook, Ms. Sanghvi, now 30, formed in 2010 a technology infrastructure company, Cove. It was recently acquired by the San Francisco-based Dropbox, whose founders she knew socially.

The Facebook network is vital to her, she said. Mr. D'Angelo has become a sounding board for Cove. She has invested her own money in her friend Mr. Morin's company, Path.

"It's extremely useful to have that network, not just for tangible things like funding and talent but also emotional support," she said. "Just having those friends has been incredibly important."

As Bill Tai, a partner at Charles River Ventures and a veteran investor, put it, "The social fabric of Silicon Valley is a dense set of overlapping spider webs, meaning everyone is connected." Mr. Tai predicted that the Facebook I.P.O. would be influential throughout the Valley. "A little tingle on one of the webs, and a lot of people will feel it."

Mr. Cohler, by all indications, has been especially deft at working his connections. In 2007, when he was looking for talented engineers for Facebook, he called a young Stanford Ph.D whom he knew, somewhat distantly, named Benjamin Ling, who was then working at Google. The two men met for lunch in the Google cafeteria. By the end of lunch, Mr. Cohler had persuaded Mr. Ling to decamp to Facebook. He worked on the Facebook platform for two years, returned to Google for another few, and then leveraged his millions and his connections to become an angel investor, one who backs small start-ups.

Entrepreneurs approach him because they know him from either Google or Facebook. He puts $25,000 to $250,000 into start-ups he fancies and prefers to go into projects with friends. Often his most valuable contribution, Mr. Ling said, was not money, but in helping friends recruit coveted engineers. That is what he did for his friend Mr. D'Angelo at Quora.

Mr. Ling, who is now chief operating officer at a social network, Badoo, compared the Valley's tech world with a tribe in a more traditional society. "You help each other, through recruiting, through fund-raising, through business development deals," he said.

In the genealogy of social networks in the Valley, the most famous network effect came from the small coterie known as the PayPal Mafia. One of PayPal's founders, Peter Thiel, was, along with Mr. Hoffman, one of the earliest investors in Facebook. Another co-founder, Elon Musk, went on to build high-end electric cars, under the name Tesla.

Two others, Russell Simmons and Jeremy Stoppelman, created the consumer review site, Yelp in 2004, which was bankrolled in part by Benchmark, the firm where Mr. Cohler is a partner. Yelp returned the favor, when it went public this year; it is now worth $1.2 billion. Mr. Ling and Mr. Stoppelman are friends. They sometimes invest together.

For a glimpse of what may happen after Facebook goes public, consider the millionaires created by Google's public offering in 2005. Overnight, these young men, most in their 20s and 30s, made so much money from Google shares that they never had to work again.

Aydin Senkut was 36 years old when Google went public. After splurging on a monthlong European holiday with his parents, he bought a house in Atherton, Calif., and a Lamborghini. He had a lot of money left. So he began investing in his friends' business endeavors. He kicked in what he described as about 10 percent of his net worth to a dozen start-ups. One of them, Aardvark, a social search engine, was bought by Google in 2010.

Mr. Senkut said he expected many more ex-Facebookers to grow angel wings after the public offering - and perhaps dabble in some far-out ideas with no immediate way to make money. "Now that you have a windfall, why not take a big risk?" he said.

© 2012, The New York Times News Service

All have left Facebook. None are retiring. With lucrative shares and a web of valuable industry contacts, they have left to either create their own companies, or bankroll their friends.

With Facebook's public offering in mid-May, more will probably join their ranks in what could be one of Facebook's lasting legacies - a new generation of tech tycoons looking to create or invest in, well, the next Facebook.

"The history of Silicon Valley has always been one generation of companies gives birth to great companies that follow," said Mr. Cohler, who, at 35, is now a partner at Benchmark Capital, and an investor in several start-ups created by his old friends from Facebook. "People who learned at one set of companies often go on to start new companies on their own."

"The very best companies, like Facebook," he continued, "end up being places where people who come there really learn to build things."

This is the story line of Silicon Valley, from Apple to Netscape to PayPal and now, to Facebook. Every public offering creates a new circle of tech magnates with money to invest. This one, though, with a jaw-dropping $100 billion valuation, will create a far richer fraternity.

Its members will be, by and large, young men, mostly white and Asian who, if nothing else, understand the value of social networks. And they have the money. Some early executives at Facebook have already sold their shares on the private market and have millions of dollars at their disposal.

Mr. Cohler, for example, is at the center of a complex web of business and social connections stemming from Facebook.

In 2002, barely two years out of Yale, he was at a party where he met Reid Hoffman, a former PayPal executive who was part of a slightly older social circle. The two men "hit it off," as Mr. Cohler recalled on the online question-and-answer platform, Quora (which was co-founded by Mr. D'Angelo). He became Mr. Hoffman's protege, assisting him with his entrepreneurial investments, and following him to his new start-up, LinkedIn.

Then, Mr. Cohler joined a company that Mr. Hoffman and several other ex-PayPal executives were backing: Facebook.

Mr. Cohler stayed at Facebook from 2005 to 2008, as it went from being a college site to a mainstream social network. One of his responsibilities was to recruit the best talent he could find, including from other companies.

Mr. Cohler left the company to retool himself into a venture capitalist. He has since been valuable to his old friends from Facebook.

Through his venture firm, Mr. Cohler has raised money for several companies founded by Facebook alumni, including Quora, created in 2010 by Mr. D'Angelo and another early Facebook engineer, Charlie Cheever. Other companies include Asana, which provides software for work management and was created in 2009 by Dustin Moskovitz, a Facebook co-founder; and Peixe Urbano, a Brazilian commerce Web site conceived by Julio Vasconcellos, who managed Facebook's Brazil office in Sao Paulo.

Mr. Cohler has put his own money into Path, a photo-sharing application formed in 2010 by yet another former Facebook colleague, Dave Morin. Path is also bankrolled by one of Facebook's venture backers: Greylock Partners, where Mr. Hoffman is a partner.

And he has invested in Instagram, which was scooped up by Facebook itself for a spectacular $1 billion. "Thrilled to see two companies near and dear to my heart joining forces!" Mr. Cohler posted on Twitter after the acquisition.

Instagram clearly was a good bet; it is impossible to say whether any of the other investments Mr. Cohler or other Facebookers are making will catch fire or whether the start-ups they found will last. Certainly, there is so much money in the Valley today that start-ups have room to grow without even a notion of turning a profit.

Ms. Sanghvi, one of the company's first 20 employees, married a fellow Facebook engineer, Aditya Agarwal. Mr. Zuckerberg attended their wedding in Goa, India.

With her husband and a third engineer from Facebook, Ms. Sanghvi, now 30, formed in 2010 a technology infrastructure company, Cove. It was recently acquired by the San Francisco-based Dropbox, whose founders she knew socially.

The Facebook network is vital to her, she said. Mr. D'Angelo has become a sounding board for Cove. She has invested her own money in her friend Mr. Morin's company, Path.

"It's extremely useful to have that network, not just for tangible things like funding and talent but also emotional support," she said. "Just having those friends has been incredibly important."

As Bill Tai, a partner at Charles River Ventures and a veteran investor, put it, "The social fabric of Silicon Valley is a dense set of overlapping spider webs, meaning everyone is connected." Mr. Tai predicted that the Facebook I.P.O. would be influential throughout the Valley. "A little tingle on one of the webs, and a lot of people will feel it."

Mr. Cohler, by all indications, has been especially deft at working his connections. In 2007, when he was looking for talented engineers for Facebook, he called a young Stanford Ph.D whom he knew, somewhat distantly, named Benjamin Ling, who was then working at Google. The two men met for lunch in the Google cafeteria. By the end of lunch, Mr. Cohler had persuaded Mr. Ling to decamp to Facebook. He worked on the Facebook platform for two years, returned to Google for another few, and then leveraged his millions and his connections to become an angel investor, one who backs small start-ups.

Entrepreneurs approach him because they know him from either Google or Facebook. He puts $25,000 to $250,000 into start-ups he fancies and prefers to go into projects with friends. Often his most valuable contribution, Mr. Ling said, was not money, but in helping friends recruit coveted engineers. That is what he did for his friend Mr. D'Angelo at Quora.

Mr. Ling, who is now chief operating officer at a social network, Badoo, compared the Valley's tech world with a tribe in a more traditional society. "You help each other, through recruiting, through fund-raising, through business development deals," he said.

In the genealogy of social networks in the Valley, the most famous network effect came from the small coterie known as the PayPal Mafia. One of PayPal's founders, Peter Thiel, was, along with Mr. Hoffman, one of the earliest investors in Facebook. Another co-founder, Elon Musk, went on to build high-end electric cars, under the name Tesla.

Two others, Russell Simmons and Jeremy Stoppelman, created the consumer review site, Yelp in 2004, which was bankrolled in part by Benchmark, the firm where Mr. Cohler is a partner. Yelp returned the favor, when it went public this year; it is now worth $1.2 billion. Mr. Ling and Mr. Stoppelman are friends. They sometimes invest together.

For a glimpse of what may happen after Facebook goes public, consider the millionaires created by Google's public offering in 2005. Overnight, these young men, most in their 20s and 30s, made so much money from Google shares that they never had to work again.

Aydin Senkut was 36 years old when Google went public. After splurging on a monthlong European holiday with his parents, he bought a house in Atherton, Calif., and a Lamborghini. He had a lot of money left. So he began investing in his friends' business endeavors. He kicked in what he described as about 10 percent of his net worth to a dozen start-ups. One of them, Aardvark, a social search engine, was bought by Google in 2010.

Mr. Senkut said he expected many more ex-Facebookers to grow angel wings after the public offering - and perhaps dabble in some far-out ideas with no immediate way to make money. "Now that you have a windfall, why not take a big risk?" he said.

© 2012, The New York Times News Service

Comments

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Further reading:

Facebook, Facebook legacy

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Tecno Pova Curve 2 5G

- Lava Yuva Star 3

- Honor X6d

- OPPO K14x 5G

- Samsung Galaxy F70e 5G

- iQOO 15 Ultra

- OPPO A6v 5G

- OPPO A6i+ 5G

- Asus Vivobook 16 (M1605NAQ)

- Asus Vivobook 15 (2026)

- Brave Ark 2-in-1

- Black Shark Gaming Tablet

- boAt Chrome Iris

- HMD Watch P1

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

© Copyright Red Pixels Ventures Limited 2026. All rights reserved.

![[Partner Content] OPPO Reno15 Series: AI Portrait Camera, Popout and First Compact Reno](https://www.gadgets360.com/static/mobile/images/spacer.png)