- Home

- Others

- Others News

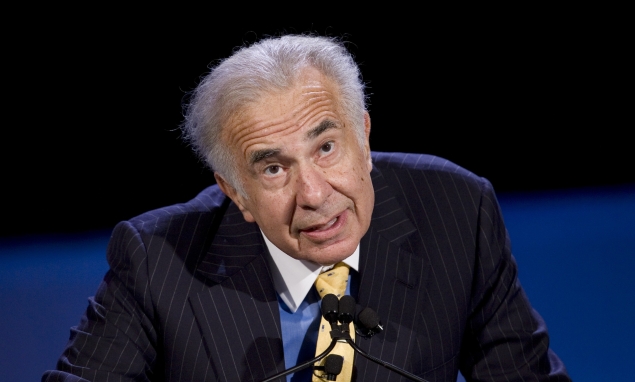

- Icahn plans dinner meet with Apple CEO to talk share buyback

Icahn plans dinner meet with Apple CEO to talk share buyback

The hedge fund billionaire, known for launching aggressive assaults on American boardrooms, caused a sensation last week when he revealed on Twitter he had taken a large position in Apple and was pushing for the company to expand its program of share buybacks already one of the market's largest.

(Also see: Carl Icahn reveals Apple stake, talks with CEO Tim Cook)

That revelation, including comments about how he thought the stock was undervalued, pushed shares of the $400 billion corporation up 5 percent on Aug 13.

But on Thursday, Apple's stock held steady at about $501.11 in late trade on the Nasdaq, resuming trade after a glitch halted trading in Nasdaq-listed securities for more than two hours.

Icahn's tweet on Thursday, which came during the trading suspension, did not reveal much else apart from the fact that he and Cook had made plans for an in-person tete-a-tete next month.

"Spoke to Tim. Planning dinner in September. Tim believes in buyback and is doing one. What will be discussed is magnitude," the billionaire said on Twitter on Thursday, without elaborating.

Apple did not respond to requests for comment. In April, the company bowed to Wall Street pressure and said it would return $100 billion to shareholders by the end of 2015 - double the amount set aside previously. It got there in part by raising its dividend 15 percent and boosting its share buyback program six-fold to $60 billion, one of the largest of its kind

As part of that program, it bought about more than $16 billion worth of stock in the June quarter, much more than analysts had expected.

Another assault

Icahn told Reuters last week that the iPhone, iPad and Mac computer maker has the ability to do a $150 billion buyback now by borrowing funds at 3 percent. And he argued that by increasing its program, Apple's stock could regain the $700 level it touched in September.

Icahn, who this year launched strong opposition to Michael Dell's $25 billion effort to take Dell Inc private, did not say how many shares of Apple he holds.

A source familiar with the matter, who declined to be named because Icahn hasn't disclosed his holdings in Apple, said the investor's stake was worth around $1 billion, a fraction of the company's market value of more than $400 billion.

He is the second prominent activist to target Apple this year. The company averted a dispute with hedge fund manager David Einhorn of Greenlight Capital, who sued Apple to try to block a proposal regarding voting on preferred shares. Einhorn later withdrew his lawsuit.

Analysts said Icahn's interest in Apple helped cement improving sentiment on the stock, as investors began to anticipate a new line-up of gadgets in the fall, including possibly a cheaper iPhone that can spear heard a deeper drive into fast-growing emerging markets.

Speculation has also persisted that the company may be planning some sort of TV or smart watch product - worn on the user's wrist - in the near future.

Cook said last month there will be products "in new categories" but gave no details.

(Also see: Apple's Tim Cook sees more 'game changers'; hints at wearable devices)

© Thomson Reuters 2013

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Tecno Pova Curve 2 5G

- Lava Yuva Star 3

- Honor X6d

- OPPO K14x 5G

- Samsung Galaxy F70e 5G

- iQOO 15 Ultra

- OPPO A6v 5G

- OPPO A6i+ 5G

- Asus Vivobook 16 (M1605NAQ)

- Asus Vivobook 15 (2026)

- Brave Ark 2-in-1

- Black Shark Gaming Tablet

- boAt Chrome Iris

- HMD Watch P1

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

![[Partner Content] OPPO Reno15 Series: AI Portrait Camera, Popout and First Compact Reno](https://www.gadgets360.com/static/mobile/images/spacer.png)