- Home

- Others

- Others News

- Apple raises $17 billion in record debt sale

Apple raises $17 billion in record debt sale

By Peter Lattman and Peter Eavis, The New York Times | Updated: 1 May 2013 11:24 IST

Click Here to Add Gadgets360 As A Trusted Source

Advertisement

With a $145 billion cash hoard, Apple could acquire Facebook, Hewlett-Packard and Yahoo. Put another way, it could buy every office building and retail space in New York, according to city estimates.

Despite its extraordinarily flush balance sheet, the technology behemoth borrowed money on Tuesday for the first time in nearly two decades. In a record-size bond deal, the company raised $17 billion, paying interest rates that hovered near the low-cost debt of the U.S. Treasury.

Apple's return to the debt markets raises a riddle: Why would a company with so much cash even bother to issue debt?

The answer has a lot to do with the frenzied state of the bond markets. Companies are issuing hundreds of billions of dollars in debt to exploit historically low interest rates. They are also feeding strong investor demand for high-quality corporate bonds as an alternative to money market funds and Treasury bills, which are paying virtually nothing.

Apple's maneuver, however, also reflects the unusual challenges of a fabulously successful company with a sinking stock price. Apple is plagued by concerns that its growth may be slowing, and its shares have plummeted from a high last fall of more than $700 to less than $400 last month.

In an effort to assuage a growing chorus of frustrated investors, the company is issuing bonds to help fund a $100 billion payout to shareholders. Apple announced last week that it planned to distribute that amount by the end of 2015 in the form of paying increased dividends and buying back its stock.

Since that announcement, Apple shares have risen 10 percent, closing at $442.78 on Tuesday.

Taking on debt can actually magnify the returns for shareholders and improve stock performance, financial specialists say. It can reduce the overall cost of the capital that a company invests in its business. In addition, after a stock buyback, there are fewer shares, which can increase their value.

Yet even as shareholders and analysts welcome the financial tactics, they emphasize that the maker of iPhones, iPads and Macs must continue to innovate and fend off increasing competition.

"This is a substantial return of cash and it's the right thing to do on many levels," said Toni Sacconaghi, an analyst with Bernstein Research. "But, ultimately, the company has to execute. This is no substitute for that."

By raising cheap debt for the shareholder payout, Apple also avoids a potentially big tax hit. About two-thirds of Apple's cash - about $102 billion - sits overseas in lower-tax jurisdictions. If it returned some of that cash to the U.S. to reward its investors, it could have significant tax consequences for the company. In some ways, the bond issue is a response to that tax situation.

"They have been so successful with their tax planning that they've created a new problem," said Martin A. Sullivan, chief economist at Tax Analysts, a publisher of tax information. "They've got so much money offshore."

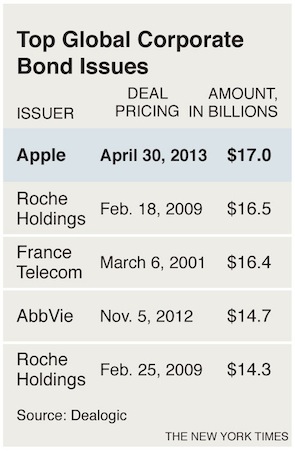

The $17 billion debt sale by Apple is the largest corporate issuance on record, surpassing a $16.5 billion deal from the drugmaker Roche Holding in 2009, according to Dealogic.

The $17 billion debt sale by Apple is the largest corporate issuance on record, surpassing a $16.5 billion deal from the drugmaker Roche Holding in 2009, according to Dealogic.

Apple joins a parade of large companies issuing debt with astonishingly low yields. Last week, Nike sold bonds that mature in 10 years that yielded only 2.27 percent. In November, Microsoft set the record for the lowest yield on a five-year bond, issuing the debt at 0.99 percent. In comparison, the yield on the 10-year Treasury on Tuesday was 1.67 percent, while the five-year note yielded 0.68 percent.

"If you look at these big companies like Apple and Microsoft doing these big, low-cost bond offerings, it's a way for them to raise money in an effort to create better returns for their shareholders," said Steven Miller, a credit analyst with Standard & Poor's Capital IQ. "The bond markets are practically begging these corporations to issue debt because of how cheap it is to raise money."

On Tuesday, Apple issued six different securities, with maturities ranging from a three-year note yielding 0.45 percent to a 30-year bond that yields 3.85 percent. The largest piece, a $5.5 billion issue, is a 10-year yielding 2.4 percent.

While good for the company, longer-term bonds with yields this low can fall steeply in price if interest rates go up, hurting investors who hold them. Still, $3 billion of the Apple debt are notes whose interest rates are periodically reset.

Despite all its cash, the credit-ratings agencies have not awarded Apple their coveted triple-A rating, citing increased competition and a concern that its future product offerings could disappoint.

Moody's Investors Service gave Apple its second-highest rating, AA1, as did Standard & Poor's, rating the company AA(PLUS). (Microsoft, Exxon Mobil, Johnson & Johnson, and Automatic Data Processing have the highest credit ratings from Moody's and S&P.)

"There are inherent long-run risks for any company with high exposure to shifting consumer preferences in the rapidly evolving technology and wireless communications sectors," wrote Gerald Granovsky, a Moody's analyst.

Apple's less-than-perfect rating did not drive away investors on Tuesday. The offering generated investor demand of about $52 billion, according to Goldman Sachs and Deutsche Bank, which led the sale of the issuance.

Desperate for returns in a yield-starved world, investors like insurance companies, pension funds and foreign governments have been snapping up corporate debt. Individual investors are also driving the demand: This year, through last Wednesday, a record $55 billion has flowed into mutual funds and exchange-traded funds that invest in corporate debt with high-quality ratings, according to the fund data provider Lipper.

Steve Jobs, Apple's co-founder and former chief executive, had long resisted calls to dispense big sums to investors. In 2010, when Apple's cash stood at $50 billion, he rejected pressure to make large distributions to shareholders. The company's cash balance continued to grow after Jobs' death in 2011, as it generated billions of dollars in earnings each quarter. Over the last 12 months, Apple operations have been generating about $150 million of cash a day.

A year ago, the new chief executive, Tim Cook, announced a decision to start returning $45 billion to shareholders. But that did not satisfy everyone. David Einhorn, chief executive of the hedge fund Greenlight Capital and an Apple shareholder, pressed the company to do even more.

The excitement surrounding Apple's bond deal on Tuesday stood in stark contrast the gloom that hung over the company when it last issued debt. In 1996, Apple faced a crisis, with shrinking sales of its niche computers and a weakening balance sheet that earned a junk credit rating. In the middle of the year, its shares reached a 10-year low.

"Will Apple Computer run out of cash soon?" asked an article in The New York Times on April 7, 1996. That summer, it tapped the bond markets, raising about $600 million and averting a crisis.

Later in the year, Jobs, who had left Apple more than a decade before, returned to the company.

© 2013, The New York Times News Service

Despite its extraordinarily flush balance sheet, the technology behemoth borrowed money on Tuesday for the first time in nearly two decades. In a record-size bond deal, the company raised $17 billion, paying interest rates that hovered near the low-cost debt of the U.S. Treasury.

Apple's return to the debt markets raises a riddle: Why would a company with so much cash even bother to issue debt?

The answer has a lot to do with the frenzied state of the bond markets. Companies are issuing hundreds of billions of dollars in debt to exploit historically low interest rates. They are also feeding strong investor demand for high-quality corporate bonds as an alternative to money market funds and Treasury bills, which are paying virtually nothing.

Apple's maneuver, however, also reflects the unusual challenges of a fabulously successful company with a sinking stock price. Apple is plagued by concerns that its growth may be slowing, and its shares have plummeted from a high last fall of more than $700 to less than $400 last month.

In an effort to assuage a growing chorus of frustrated investors, the company is issuing bonds to help fund a $100 billion payout to shareholders. Apple announced last week that it planned to distribute that amount by the end of 2015 in the form of paying increased dividends and buying back its stock.

Since that announcement, Apple shares have risen 10 percent, closing at $442.78 on Tuesday.

Taking on debt can actually magnify the returns for shareholders and improve stock performance, financial specialists say. It can reduce the overall cost of the capital that a company invests in its business. In addition, after a stock buyback, there are fewer shares, which can increase their value.

Yet even as shareholders and analysts welcome the financial tactics, they emphasize that the maker of iPhones, iPads and Macs must continue to innovate and fend off increasing competition.

"This is a substantial return of cash and it's the right thing to do on many levels," said Toni Sacconaghi, an analyst with Bernstein Research. "But, ultimately, the company has to execute. This is no substitute for that."

By raising cheap debt for the shareholder payout, Apple also avoids a potentially big tax hit. About two-thirds of Apple's cash - about $102 billion - sits overseas in lower-tax jurisdictions. If it returned some of that cash to the U.S. to reward its investors, it could have significant tax consequences for the company. In some ways, the bond issue is a response to that tax situation.

"They have been so successful with their tax planning that they've created a new problem," said Martin A. Sullivan, chief economist at Tax Analysts, a publisher of tax information. "They've got so much money offshore."

Apple joins a parade of large companies issuing debt with astonishingly low yields. Last week, Nike sold bonds that mature in 10 years that yielded only 2.27 percent. In November, Microsoft set the record for the lowest yield on a five-year bond, issuing the debt at 0.99 percent. In comparison, the yield on the 10-year Treasury on Tuesday was 1.67 percent, while the five-year note yielded 0.68 percent.

"If you look at these big companies like Apple and Microsoft doing these big, low-cost bond offerings, it's a way for them to raise money in an effort to create better returns for their shareholders," said Steven Miller, a credit analyst with Standard & Poor's Capital IQ. "The bond markets are practically begging these corporations to issue debt because of how cheap it is to raise money."

On Tuesday, Apple issued six different securities, with maturities ranging from a three-year note yielding 0.45 percent to a 30-year bond that yields 3.85 percent. The largest piece, a $5.5 billion issue, is a 10-year yielding 2.4 percent.

While good for the company, longer-term bonds with yields this low can fall steeply in price if interest rates go up, hurting investors who hold them. Still, $3 billion of the Apple debt are notes whose interest rates are periodically reset.

Despite all its cash, the credit-ratings agencies have not awarded Apple their coveted triple-A rating, citing increased competition and a concern that its future product offerings could disappoint.

Moody's Investors Service gave Apple its second-highest rating, AA1, as did Standard & Poor's, rating the company AA(PLUS). (Microsoft, Exxon Mobil, Johnson & Johnson, and Automatic Data Processing have the highest credit ratings from Moody's and S&P.)

"There are inherent long-run risks for any company with high exposure to shifting consumer preferences in the rapidly evolving technology and wireless communications sectors," wrote Gerald Granovsky, a Moody's analyst.

Apple's less-than-perfect rating did not drive away investors on Tuesday. The offering generated investor demand of about $52 billion, according to Goldman Sachs and Deutsche Bank, which led the sale of the issuance.

Desperate for returns in a yield-starved world, investors like insurance companies, pension funds and foreign governments have been snapping up corporate debt. Individual investors are also driving the demand: This year, through last Wednesday, a record $55 billion has flowed into mutual funds and exchange-traded funds that invest in corporate debt with high-quality ratings, according to the fund data provider Lipper.

Steve Jobs, Apple's co-founder and former chief executive, had long resisted calls to dispense big sums to investors. In 2010, when Apple's cash stood at $50 billion, he rejected pressure to make large distributions to shareholders. The company's cash balance continued to grow after Jobs' death in 2011, as it generated billions of dollars in earnings each quarter. Over the last 12 months, Apple operations have been generating about $150 million of cash a day.

A year ago, the new chief executive, Tim Cook, announced a decision to start returning $45 billion to shareholders. But that did not satisfy everyone. David Einhorn, chief executive of the hedge fund Greenlight Capital and an Apple shareholder, pressed the company to do even more.

The excitement surrounding Apple's bond deal on Tuesday stood in stark contrast the gloom that hung over the company when it last issued debt. In 1996, Apple faced a crisis, with shrinking sales of its niche computers and a weakening balance sheet that earned a junk credit rating. In the middle of the year, its shares reached a 10-year low.

"Will Apple Computer run out of cash soon?" asked an article in The New York Times on April 7, 1996. That summer, it tapped the bond markets, raising about $600 million and averting a crisis.

Later in the year, Jobs, who had left Apple more than a decade before, returned to the company.

© 2013, The New York Times News Service

Comments

For details of the latest launches and news from Samsung, Xiaomi, Realme, OnePlus, Oppo and other companies at the Mobile World Congress in Barcelona, visit our MWC 2026 hub.

Further reading:

Apple

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

© Copyright Red Pixels Ventures Limited 2026. All rights reserved.