- Home

- Mobiles

- Mobiles News

- Quarterly Smartphone Shipments Top 300 Million; Android Extends Lead: IDC

Quarterly Smartphone Shipments Top 300 Million; Android Extends Lead: IDC

By Agence France-Presse | Updated: 16 August 2014 13:06 IST

Advertisement

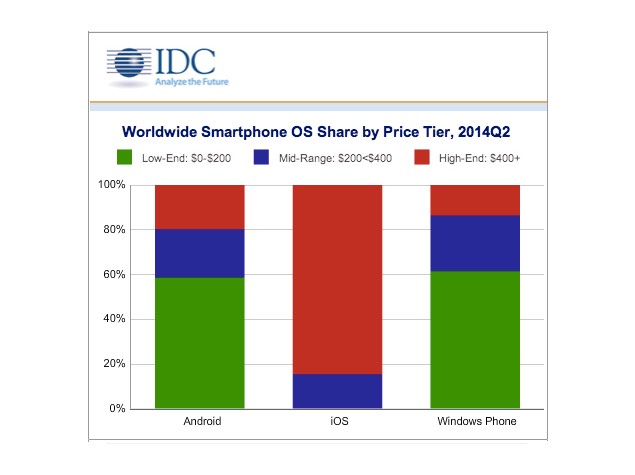

A surge in low-cost smartphone sales, notably in emerging markets, helped the Google Android platform extend its dominance in the second quarter, a survey showed Thursday.

The report by market tracker IDC said Android phone sales were up 33 percent over the past year to 255 million units, and accounted for 84.7 percent of all global smartphone sales in the March-June period.

The overall market grew 25 percent to 301 million units, IDC said, with Apple, Microsoft Windows and BlackBerry failing to keep pace.

"With many of its (manufacturing) partners focusing on the sub-$200 segments, Android has been reaping huge gains within emerging markets," says Ramon Llamas, research manager with IDC.

Top Five Smartphone Operating Systems, Worldwide Shipments, and Market Share, 2014Q2 (Units in Millions). Source: IDC

"During the second quarter, 58.6 percent of all Android smartphone shipments worldwide cost less than $200 off contract, making them very attractive compared to other devices."

Sales of the Apple iPhone rose to 35.2 million units in the quarter, but with growth slower than Android, Apple's market share fell to 11.7 percent from 13 percent last year in the same period.

Windows Phone sales meanwhile slipped more than nine percent from a year ago to 7.4 million units, while its market share dropped to 2.5 percent.

BlackBerry's woes deepened despite modest gains from the first quarter of 2014. On a year-to-year basis, sales fell 78 percent and its market share dropped to 0.5 percent.

The figures were largely in line with a similar survey last month from Strategy Analytics.

The report by market tracker IDC said Android phone sales were up 33 percent over the past year to 255 million units, and accounted for 84.7 percent of all global smartphone sales in the March-June period.

The overall market grew 25 percent to 301 million units, IDC said, with Apple, Microsoft Windows and BlackBerry failing to keep pace.

"With many of its (manufacturing) partners focusing on the sub-$200 segments, Android has been reaping huge gains within emerging markets," says Ramon Llamas, research manager with IDC.

| Operating System | 2Q14 Shipment Volume | 2Q14 Market Share | 2Q13 Shipment Volume | 2Q13 Market Share | 2Q14/2Q13 Growth |

| Android | 255.3 | 84.7% | 191.5 | 79.6% | 33.3% |

| iOS | 35.2 | 11.7% | 31.2 | 13.0% | 12.7% |

| Windows Phone | 7.4 | 2.5% | 8.2 | 3.4% | -9.4% |

| BlackBerry | 1.5 | 0.5% | 6.7 | 2.8% | -78.0% |

| Others | 1.9 | 0.6% | 2.9 | 1.2% | -32.2% |

| Total | 301.3 | 100% | 240.5 | 100% | 25.3% |

Top Five Smartphone Operating Systems, Worldwide Shipments, and Market Share, 2014Q2 (Units in Millions). Source: IDC

"During the second quarter, 58.6 percent of all Android smartphone shipments worldwide cost less than $200 off contract, making them very attractive compared to other devices."

Sales of the Apple iPhone rose to 35.2 million units in the quarter, but with growth slower than Android, Apple's market share fell to 11.7 percent from 13 percent last year in the same period.

Windows Phone sales meanwhile slipped more than nine percent from a year ago to 7.4 million units, while its market share dropped to 2.5 percent.

BlackBerry's woes deepened despite modest gains from the first quarter of 2014. On a year-to-year basis, sales fell 78 percent and its market share dropped to 0.5 percent.

The figures were largely in line with a similar survey last month from Strategy Analytics.

Comments

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Vivo V50 Lite 4G

- Redmi Note 14s

- Samsung Galaxy F16 5G

- iQOO Neo 10R

- Tecno Camon 40 Premier 5G

- Infinix Note 50 Pro+

- Infinix Note 50 Pro

- Infinix Note 50

- Asus Zenbook A14 (UX3407RA)

- Tecno Megabook S14

- Lenovo Idea Tab Pro

- Lenovo Tab K9

- boAt Ultima Prime

- boAt Ultima Ember

- Haier M95E

- Sony 65 Inches Ultra HD (4K) LED Smart TV (KD-65X74L)

- Sony PlayStation 5 Pro

- Sony PlayStation 5 Slim Digital Edition

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IC318DNUHC)

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IA318VKU)

© Copyright Red Pixels Ventures Limited 2025. All rights reserved.