- Home

- Mobiles

- Mobiles News

- China's mini Apple takes slice of smartphone pie

China's mini Apple takes slice of smartphone pie

Less than three years after its founding, the smartphone maker is valued at $4 billion and evokes Apple-like adoration from its fans, some of whom are desperate enough to skip work for a shot at buying the latest product the day it goes on sale.

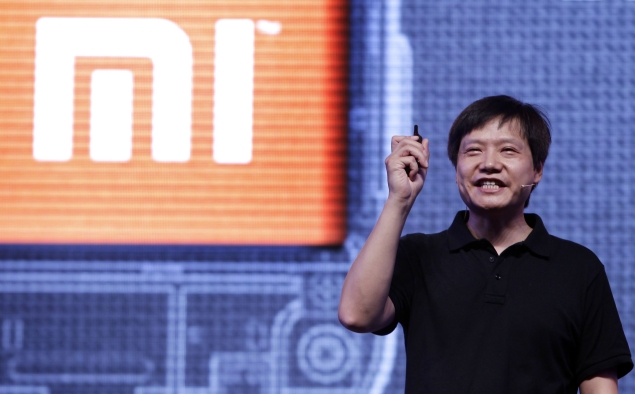

Founder Lei Jun dresses like the late Steve Jobs, in jeans and a black top. He has created a fervent fan base for Xiaomi's moderately priced high-end smartphones by mimicking Apple Inc's marketing tactic of attaching an aura of exclusivity around its products.

Before Xiaomi, the 42-year-old Lei was a key investor in China's early Internet scene, co-founding startups including Joyo.cn, which was eventually sold to Amazon.com Inc, and the recently listed YY Inc.

Born in Xiantao, a small city in China's central Hubei province better known for breeding Olympic gymnasts than billionaire technocrats, Lei brushes off comparisons to Jobs but concedes that the Apple visionary was an inspiration.

"China's media say I am China's Steve Jobs," Lei told Reuters in an interview.

"I will take this as a compliment but such kind of comparison brings us huge pressure," said Lei, who grew up assembling radios as a hobby. "Xiaomi and Apple are two totally different companies. Xiaomi's based on the Internet. We are not doing the same thing as Apple."

Hot sales and fans

Xiaomi has already sold 300,000 of its latest phone model, launched in October. The Xiaomi phone 2 has specifications similar to those of Samsung Electronics' Galaxy S3 and Apple's iPhone5 but a top-of-the-line model sells for about $370, half the price of an iPhone5.

Unlike the big domestic smartphone players, such as Lenovo Group, ZTE Corp and Huawei Technologies, which work with telecom carriers to sell a large volume of smartphones, Xiaomi sells most of its phones online and in small batches.

This small volume strategy creates pent-up demand that gives Xiaomi free marketing buzz. The first batch of 50,000 phones released on October 30 sold out in less than two minutes. Subsequent larger batches have also sold out in minutes.

Lei, who has nearly 4 million followers on China's popular microblogging platform, Weibo, feeds the buzz by dangling teasers about new products and launch dates.

"We're not a company that chases sales volume. We chase customer satisfaction. We look for ways to give the customer a great surprise," Lei said.

His vision for an exclusive mid-tier brand that builds up incrementally, rather than swamping the market, has found financial backers. In June, Xiaomi raised $216 million from Singapore's sovereign wealth fund, the Government of Singapore Investment Corp, and a few of Lei's friends, local media reported, giving it a valuation of $4 billion.

"China is ripe for its own Apple, HTC or Samsung," said Hans Tung, managing partner at Qiming Venture Partners, a venture firm backing Xiaomi. "The country is big enough, there are enough mobile Internet users and mobile phone consumers. Therefore having its own mobile ecosystem built up by a domestic brand makes sense."

Xiaomi, which was founded in April 2010 and only started selling smartphones in October 2011, is on track to sell 7 million units this year, exceeding its target of 2 million.

Xiaomi is already profitable and is expected to rake in sales of up to 13 billion yuan this year.

"Our product only sold for a year and hit sales of $2 billion. That is pretty impressive," Lei said, adding Xiaomi was not considering an initial public offering within the next five years.

Tung said Xiaomi's net margins were 10 percent. This suggests its net profit could hit $200 million this year.

Mo Xiaohua, a 24-year-old accountant, is a proud Xiaomi fan who only recently bought her first Xiaomi phone. For many who use Xiaomi phones, the customisable themes and the weekly updates are a big draw.

"I like Xiaomi because among China's brand smartphones, its value is the best," Mo said. "Now that we have such a good China branded phone, we need to support it."

'Black back flats'

Xiaomi has its fair share of detractors who doubt it will have a happy ending. They say the smartphone game in China can only be won with wide distribution and high volume or a big brand with distinctive designs.

Xiaomi, whose attraction is its price and high technical specifications, does not win points for cutting-edge design.

"This is a world where people are now cranking out 'black back flats', that's what all these phones are when you put 10 on the table. Xiaomi is not going to stick out," said Michael Clendenin, managing director at RedTech Advisors. "In this world, the market is driven by two things: one is massive volume and two huge brands."

ZTE and Huawei have set smartphone sales targets for this year at about 30 million and 60 million respectively. The firms have traditionally dominated the cheap low-end smartphone segment but have been pushing into the mid-price range.

ZTE said it launched 11 types of smartphones in the mid-price range of 1,500-2,500 yuan this year, up from six last year. Apple released its mid-range tablet, the iPad Mini, in China on Friday.

"Xiaomi had great headline appeal a year ago but the problem is now you have got guys like ZTE and Huawei and Meizu with phones that are priced in a similar range," Clendenin said.

China is expected to surpass the United States as the world's largest smartphone market this year with 165-170 million unit sales, up from 78 million last year, Gartner said.

Analysts said Xiaomi had to ramp up volume and address technical problems and a shortage of customer service centres if it wanted a shot at the big league.

"One of the challenges of being in the middle is that you can get squeezed," said Duncan Clark, chairman of Beijing-based consultancy BDA.

Lei is resolute that he will prove the naysayers wrong.

"In this industry, I think the most important thing is to get love from your customers," he said. "If you are popular with your customers, you succeed."

© Thomson Reuters 2012

Catch the latest from the Consumer Electronics Show on Gadgets 360, at our CES 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Samsung Galaxy A07 5G

- Vivo Y500i

- OnePlus Turbo 6V

- OnePlus Turbo 6

- Itel Zeno 20 Max

- OPPO Reno 15 Pro Mini 5G

- Poco M8 Pro 5G

- Motorola Signature

- Lenovo Yoga Slim 7x (2025)

- Lenovo Yoga Slim 7a

- Realme Pad 3

- OPPO Pad Air 5

- NoiseFit Pro 6R

- Xiaomi Watch 5

- Acerpure Nitro Z Series 100-inch QLED TV

- Samsung 43 Inch LED Ultra HD (4K) Smart TV (UA43UE81AFULXL)

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)