-

Budget 2020: Investment in Quantum Computing, BharatNet, ESOP Tax Relaxation, Data Centre Parks, More1 February 2020

Budget 2020: Investment in Quantum Computing, BharatNet, ESOP Tax Relaxation, Data Centre Parks, More1 February 2020 -

Budget 2020: Finance Minister Nirmala Sitharaman Proposes New Electronics Manufacturing Scheme1 February 2020

Budget 2020: Finance Minister Nirmala Sitharaman Proposes New Electronics Manufacturing Scheme1 February 2020 -

Budget 2020 Live: When and Where to Watch Finance Minister Nirmala Sitharaman’s Speech on TV, Internet, and Mobile1 February 2020

Budget 2020 Live: When and Where to Watch Finance Minister Nirmala Sitharaman’s Speech on TV, Internet, and Mobile1 February 2020 -

Government Likely to Raise Import Duties on Electronics Next Week25 January 2020

Government Likely to Raise Import Duties on Electronics Next Week25 January 2020

- Home

- Mobiles

- Mobiles News

- Union Budget 2020 Expectations: What the Smartphone, Telecom Industry Seeks From Finance Minister

Union Budget 2020 Expectations: What the Smartphone, Telecom Industry Seeks From Finance Minister

Mobile phone and component manufacturers expect export incentives and lower GST on mobile parts. At the same time, analysts expect import duties on certain components to go up even more.

By Tasneem Akolawala | Updated: 31 January 2020 15:47 IST

Union Budget 2020 is expected to bring reforms to tackle the current slowdown

Click Here to Add Gadgets360 As A Trusted Source

Advertisement

Union Budget 2020 is slated to be announced on February 1 i.e. tomorrow, and Finance Minister Nirmala Sitharaman is expected to make several announcements to help solve the current slowdown and stimulate consumption and growth. There are high expectations of revisions of several policies, and for the smartphone industry in particular, the government is largely expected to introduce measures to help boost manufacturing. To recall, last year the custom duty on cellular handsets was increased to 20 percent to discourage import and compel local manufacturing.

This year, the government is expected to take a progressive step to help make India an electronics manufacturing and export hub. Mobile phone and component manufacturers expect export incentives and lower GST on mobile parts. At the same time, analysts expect import duties on certain components to go up even more. Nipun Marya, Director-Brand Strategy, Vivo India says, “The Government is determined to make India an electronics manufacturing and export hub. Hence, we are really hopeful that the budget will be a progressive nudge in this direction."

Abhilash Kumar, Research Analyst, Counterpoint Research believes that the US-China trade war is an opportunity for India to attract big players looking for less dependency on China for manufacturing. "India has the potential to be a key manufacturing hub in next 4-5 years. This is driven by growth in smartphones shipments and other verticals like television, PCs and other consumer segments. Of course, tariff barriers play a major role in driving local sourcing across the globe with some of the countries preferring the approach including India but I believe its time to go beyond that and therefore we believe special incentive schemes and subsidies for mobile phones as well as components manufacturing to be outlined in the budget so that a focus will be more on value addition. Having said that we still believe that the government will raise import duties on certain components and at the same time will come up with assertive policies on exports for its boost," he says.

Kumar adds, "If India can attract and focus on anchor companies (big players) to drive local value addition, that will have more impact and pull other smaller players in the ecosystem to start their base in India. The much talked about the '20-odd component manufacturing ecosystem' can be promoted in the budget through the Modified Special Incentive Package Scheme (MSIPS)."

In its report titled “Modified Special Incentive Package Scheme (M-SIPS) 2.0'', the Internet and Mobile Association of India (IAMAI) has suggested that the incentive under M-SIPS for smartphone players should be raised to 30 percent of the capital expenditure to help offset the loss of revenue faced by companies when they move a component manufacturing facility to India. In the event that a company decides to move its manufacturing unit to India, the cost will result in loss of revenue of about two to three quarters. The increase in incentive will help to offset this loss of revenue, and encourage players to make the shift out of China and Vietnam. The report also advises on developing transport and logistics infrastructure, introduce labour reforms, and provide focussed skill training.

Even the Federation of Indian Export Organisations believes that many big players are looking at relocation outside of China, and India could be a compelling choice, but its lack in ease of investment could be a hindrance. Sharad Kumar Saraf, President at FIEO, advises, “Government may nominate nodal officer for every investor investing beyond a threshold limit whose job should be to provide all clearances/ approval to the investor from the statutory agencies. Moreover, the actual investment takes place in the State who have to be taken on board to facilitate such investment as regulatory processes in States are still cumbersome.”

Prabhu Ram, Head- Industry Intelligence Group (IIG), CyberMedia (CMR), feels that India has immense potential to become the mobile manufacturing hub. He asserts that the government should provide the directional impetus required for the mobile handset industry to grow in India. “The forthcoming Union Budget should focus on bolstering and accelerating smartphone components production, and enhanced value addition in India. The smartphone industry in India has been a resounding Make in India success story. India has the potential, with its large domestic market, affordable and qualified labour resources and a stable geo-political environment to support its mobile handsets growth story,” he notes.

Talking about other electronic gadgets like TVs and refrigerators, Manish Sharma, President and CEO, Panasonic India and South Asia says, “Our expectation from the Union Budget 2020 is to see reforms that drive consumption and improve consumer demand. The decision to exempt basic custom duty on open cells from 5 percent to 0 percent was a welcome move last year and allowed us to pass on the benefits to the consumers by reduction in TV prices. Such initiatives with phased manufacturing programmes are helpful. However, the consumer appliances industry witnessed a flat growth over the last two years, and we urge the government to continue in the trajectory of positive policies to lend support and drive growth in the sector.” He also advises reduction in GST on TVs and refrigerators to help reduce costs and improve penetration in the markets.

The crisis battling telecom operators are also expecting an ease of doing business in the form of subsidy, or an easy loan scheme. Counterpoint's Kumar adds, “Operators are expecting ease of doing business in India. We can expect a relaxation on the operator dues in the form of some subsidy or extension of the time period to pay the dues or say an easy loan scheme for them." Rajan Mathews, director general of industry body COAI, seeks a reduction in license fee and a cut in spectrum usage charges to 4-5 percent.

Comments

Catch the latest from the Consumer Electronics Show on Gadgets 360, at our CES 2026 hub.

Further reading:

Union Budget 2020, Budget 2020, Budget 2020 Expectations, Indian Smartphone Industry, Telecom Industry

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Vivo Y500i

- OnePlus Turbo 6V

- OnePlus Turbo 6

- Itel Zeno 20 Max

- OPPO Reno 15 Pro Mini 5G

- Poco M8 Pro 5G

- Motorola Signature

- Vivo Y50e 5G

- Lenovo Yoga Slim 7x (2025)

- Lenovo Yoga Slim 7a

- Realme Pad 3

- OPPO Pad Air 5

- Xiaomi Watch 5

- Huawei Watch 10th Anniversary Edition

- Acerpure Nitro Z Series 100-inch QLED TV

- Samsung 43 Inch LED Ultra HD (4K) Smart TV (UA43UE81AFULXL)

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

© Copyright Red Pixels Ventures Limited 2026. All rights reserved.

-

ISRO’s PSLV Suffers Second Failure as Third-Stage Glitch Sends Rocket Off Course

ISRO’s PSLV Suffers Second Failure as Third-Stage Glitch Sends Rocket Off Course

-

NASA Confirms First Medical Evacuation in ISS’s 25-Year History

NASA Confirms First Medical Evacuation in ISS’s 25-Year History

-

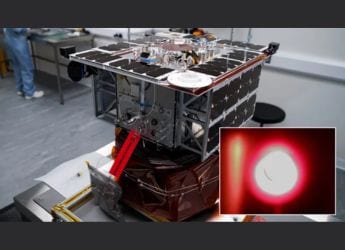

Space Forge Tests World’s First Commercial Semiconductor Factory in Space

Space Forge Tests World’s First Commercial Semiconductor Factory in Space

-

83rd Golden Globe Awards Full List of Winners: Hamnet, The Pitt, Adolescence, and More

83rd Golden Globe Awards Full List of Winners: Hamnet, The Pitt, Adolescence, and More