- Home

- Mobiles

- Mobiles News

- BlackBerry's Partnership with Foxconn Signals Shifting Priorities

BlackBerry's Partnership with Foxconn Signals Shifting Priorities

But even in Indonesia, BlackBerry's fortunes have changed. Last week, when the company started selling the Z3, a smartphone it made specifically for this market, consumers reacted with a collective shrug.

Nevertheless, the arrival of the BlackBerry Z3, a touch-screen device mainly notable for its budget-friendly $190 price, signals a new path for the struggling company. BlackBerry, like most phone-makers, has long contracted out the manufacturing of its phones, but the Z3 has also been designed and distributed by Foxconn Technology Group, the giant Taiwanese manufacturer.

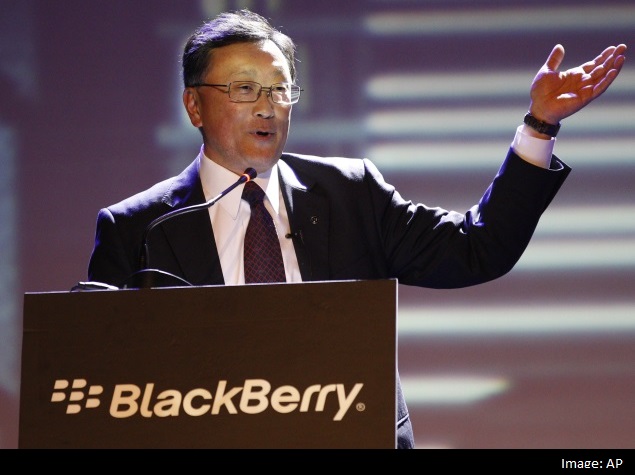

BlackBerry's partnership with Foxconn, a company perhaps best known as a builder of iPhone and iPads, comes at a critical time for BlackBerry. Although sales of the company's devices have plummeted globally in recent years, the revenue from the phone business remains vital as John S. Chen, BlackBerry's chairman and chief executive, tries to shift the organization's focus to services and software.

By reaching a deal with Foxconn, Chen may have bought himself some time - if only a little.

(Also see: BlackBerry signs unique handset production deal with Foxconn)

"John Chen is just sustaining the handset business as he sorts out the way ahead," said Nick Spencer, an analyst with ABI Research in London. "But at these low volumes, you wonder about BlackBerry's viability. Consumer electronics is about scale."

While a four-hour tour of stores in Jakarta last week found no lines for, and relatively little shopper interest in, the phone, BlackBerry said in a blog post that the Z3 had attracted substantial interest and was sold out by Friday. It did not provide any sales figures.

In the last quarter, the company sold 1.3 million phones, compared with 6 million during the same period a year earlier.

But without the phone business, BlackBerry would be a significantly smaller company. During its last quarter, the ailing hardware business still generated 37 percent of BlackBerry's $976 million in revenue. A year earlier phones accounted for 61 percent of $2.7 billion in sales.

While Foxconn cannot do anything to reverse BlackBerry's popularity slide, the partnership will eliminate several financial uncertainties for Chen.

A large portion of the $5.9 billion loss that BlackBerry reported for last year came from writing off unsold phones and unneeded phone parts. Foxconn now assumes that risk.

In an interview last week in Jakarta, Chen offered his theory about Foxconn's interest in the partnership.

"Sixty to 75 percent of all phones is common parts," Chen said. "Things that we order and that they don't use, they can be used somewhere else. They could be in an HP printer or a Canon whatever or a Dell computer or an iPhone and vice versa."

Two representatives for Foxconn declined to comment directly on its relationship with BlackBerry.

"We are focused on supporting our customers by providing services such as research and development, design, manufacturing and logistics support," the company said in a statement. "Moving up the value chain to provide a full suite of services has been our ongoing strategy."

Michael J. Palma, an electronics manufacturing services analyst at IDC, said that by no longer sourcing parts by itself, BlackBerry will benefit from Foxconn's buying power while having a clearer idea of the final cost of handsets from the outset. "I think that's smart," he added.

Foxconn will also help BlackBerry shorten development cycles. BlackBerry has a long history of being slow to develop new products - BlackBerry 10, its most recent flagship product, was repeatedly delayed.

Chen said BlackBerry employees handled the software development for the Z3 and supervised Foxconn's work on its hardware in a process that took four months. "This is probably the fastest in the industry," he said.

(Palma said although Apple typically takes a year to develop new iPhones, many companies now turn around new models in three to six months. As well, Indonesian wireless carriers are also faster to approve new models than their U.S. counterparts.)

It also is a fortuitous time for Foxconn. Palma said BlackBerry was dealing with a Foxconn subsidiary, Foxconn International Holdings, which is known in the industry as FIH. The subsidiary, however, has been struggling. In the past, its main client was Nokia, another company whose phones have fallen out of favor with consumers. (Nokia is now part of Microsoft.)

Palma said FIH had since turned mainly to small phone companies in China for its business. "BlackBerry becomes a nice add-on," he added.

Chen offered his opinion of what Foxconn hopes to gain.

Profits from manufacturing, a highly competitive business, are slim. But by developing its design and engineering business, Chen said that Foxconn was "starting to get more and more into the value-added part of the equation."

The automobile industry moved in a similar direction several years ago. Large parts suppliers, like Magna International of Aurora, Ontario, now design and engineer the parts, and even produce full systems like interiors and wiring.

Despite what he views as the success of the Z3's development, Chen said BlackBerry would continue to design the hardware and software for more expensive phones aimed at the European and North American markets, at least for now.

As for BlackBerry's slump in Indonesia, several analysts say the blame rests largely on the company. IDC estimates BlackBerry's market share in Indonesia was 4 percent during the first quarter of this year, down from 25 percent a year earlier.

The company's BlackBerry Messenger, or BBM, instant messaging service remains exceptionally popular in Indonesia. But once BBM became available on Android phones, many Indonesians decided they could do without BlackBerry handsets, said Ryan Lai, an IDC analyst in Kuala Lumpur, Malaysia.

"Cheaper handsets and a larger apps ecosystem also pulled Indonesian consumers towards Android," he said.

The Z3 may be less costly than previous BlackBerry offerings, but that may not be enough. Ruby Alamsyah, an independent technology analyst in Jakarta, said that Android phones now are sold in Indonesia for as little as the equivalent of $88, less than half the price of the Z3.

"I think the Z3, with the optional engraving of 'Jakarta' on the back, is only a marketing gimmick," he said. "They still want to recover in the Indonesian market but I don't think they'll get it back if the price is still higher than most cheap Androids."

© 2014 New York Times News Service

For details of the latest launches and news from Samsung, Xiaomi, Realme, OnePlus, Oppo and other companies at the Mobile World Congress in Barcelona, visit our MWC 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Apple iPhone 17e

- AI+ Pulse 2

- Motorola Razr Fold

- Honor Magic V6

- Leica Leitzphone

- Samsung Galaxy S26+

- Samsung Galaxy S26 Ultra

- Samsung Galaxy S26

- MacBook Pro 16-Inch (M5 Max, 2026)

- MacBook Pro 16-Inch (M5 Pro, 2026)

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Apple iPad Air 13-Inch (2026) Wi-Fi

- Huawei Watch GT Runner 2

- Amazfit Active 3 Premium

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)