- Home

- Mobiles

- Mobiles News

- Apple Pay Looks to Accelerate Mobile Payments Push

Apple Pay Looks to Accelerate Mobile Payments Push

With its new mobile payment system, Apple is likely to use its market power to accelerate adoption of smarter retail payment technology and boost security amid growing concern over hacking.

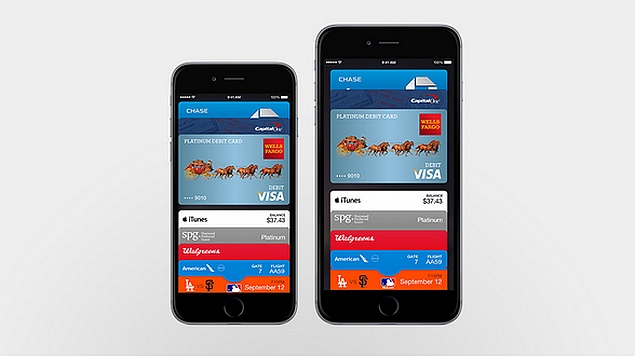

Apple, as part of an ambitious series of product announcements Tuesday, unveiled its "Apple Pay" system that will allow consumers with the upcoming iPhones to tap their handsets at retailers instead of using debit or credit cards.

Apple chief Tim Cook said the Apple Pay system would replace an "antiquated payment process" with "an entirely new" system offering greater convenience and security.

Cook said that each day in the United States, alone, "that's 200 million times that we scramble through our credit cards and go through what is a fairly antiquated payment process."

Apple Pay will use a dedicated secure chip that communicates with a retail terminal through a near-field communication (NFC) antenna in the phone.

Even though this technology has been available for years, adoption in the US has been slow because of competing standards, analysts said.

(Also see: iPhone 6, iPhone 6 Plus, Watch Price Revealed; 128GB iPhone Now a Reality)

Cook said other efforts have failed because the companies introducing mobile wallets were working on the basis of "their self-interest" instead of the user experience.

Banks lined up

Apple has lined up most of the largest US banks for the system, and many big retail outlets have agreed to install compatible payment terminals.

This helps solve the "chicken and egg" conundrum that has prevented widespread adoption of mobile payments, said Roger Kay at Endpoint Technologies.

"You need consumers to get the enabled systems, and retailers and banks to process all that," Kay told AFP.

"No one wanted to move before anyone else did. So if Apple gathers a group of partners, it may establish a base of functionality that will work."

Apple Pay supports credit and debit cards from American Express, MasterCard and Visa, issued by banks including Bank of America, Capital One, Chase, Citi and Wells Fargo, representing 83 percent of credit card purchase volume in the US.

The payment system will launch in October at some 200,000 retail locations, including Bloomingdale's, Duane Reade, Macy's, McDonald's, Sephora, Staples, Subway, Walgreens and Whole Foods Market.

"Security and privacy is at the core of Apple Pay," said Apple vice president Eddy Cue.

"When you're using Apple Pay in a store, restaurant or other merchant, cashiers will no longer see your name, credit card number or security code, helping to reduce the potential for fraud.

"Apple doesn't collect your purchase history, so we don't know what you bought, where you bought it or how much you paid for it."

Payments can also be made through the new Apple Watch, which will allow users of older iPhones to use the system.

Igniting interest in mobile

"Apple Pay will ignite consumers' interest in mobile payments by providing a seamless, secure, and easy way to pay both in store and on the go," said Denee Carrington at Forrester Research.

"By partnering with the leading merchants across retail, grocery, drugstore and dining, consumers can use Apple Pay with merchants they shop every day - which will accelerate the growth of mobile payments in the US," she said.

Gartner researchers predicted recently that mobile payments would top $721 billion, with some 450 million users, by 2017, but noted that growth has been sluggish in North America.

Eden Zoller at the research firm Ovum said Apple's launch "is nothing new in the m-payments space," but noted that "if anyone can help make this happen then it is probably Apple, although it will need strong partnerships."

(Also see: iPhone 6 and iPhone 6 Plus Available in India October 17; Price Unknown)

And research firm IHS noted that "Apple holds a number of advantages" over others because "it already has millions of user credit card details on file from Apple IDs, which users can choose to simply add to Apple Pay."

IHS said Apple already has strong software and hardware integration to store information and that by focusing on hardware sales it does not need Apple Pay to generate additional revenues.

Endpoint's Kay said some questions remain, notably whether Apple will allow rivals to tap into the system

"Apple doesn't alway play well with others," he said. "Apple is jealous about how it holds technology to its chest."

If other players in the sector want to use a different system for Android devices, "that may be an inhibitor because a lot of people don't have Apple phones," Kay said.iPhone 6, iPhone 6 Plus, Apple Watch Launch

For details of the latest launches and news from Samsung, Xiaomi, Realme, OnePlus, Oppo and other companies at the Mobile World Congress in Barcelona, visit our MWC 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)