- Home

- Laptops

- Laptops News

- Icahn, Southeastern mount challenge to Dell buyout

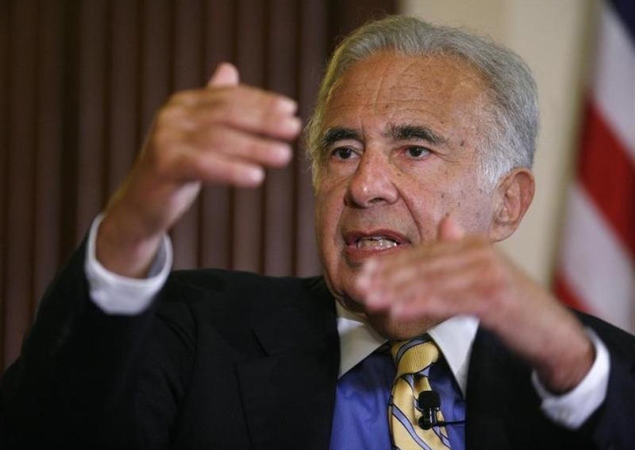

Icahn, Southeastern mount challenge to Dell buyout

Michael Dell, major shareholders such as Southeastern and billionaire Icahn are waging a battle over the future of the world's third largest personal computer maker, once a tech-industry high flyer, but now struggling to evolve as people embrace smartphones and tablet computers.

Michael Dell and private equity firm Silver Lake want to take the company private for $13.65 per share, making it the largest private equity-led buyout since the 2008 financial crisis.

But Icahn and Southeastern proposed an alternative to a take-private buyout that lets shareholders get $12 of cash for every share they own, as well as keep their stock. Given that they retain their stake in the company and that the rival offer is for $13.65 a share, every stock owned takes on a value of $1.65, Icahn and Southeastern argue. (http://r.reuters.com/tug97t)

At $12 apiece, the cash portion of Icahn's and Southeastern's offer will come to $21 billion.

The initial reaction from shareholders to the rival proposal was favorable.

"It's improvement. It gives people a choice. The other (proposal) comes across like a ramrod," said Donald Yacktman, founder and CEO of Yacktman Asset Management, holds 14.8 million shares, according to Thomson Reuters data.

"Whichever way things evolve, what this is doing is forcing better capital allocation than we have seen in the last five years."

Southeastern, T. Rowe Price and other major investors in the company have publicly criticized Michael Dell's buyout as severely undervaluing a company that still operates a large enterprise-focused computing business in addition to its ailing PC division.

Icahn's offer "gives us the opportunity to continue our participation in Dell's operating business and thus we believe it to be superior," said Tim Piechowski, associate portfolio manager, Alpine Capital Research, St Louis, Missouri, which owned 2.2 million shares as of December 31.

Dell shares were up 1.2 percent at $13.48 in afternoon trading.

TAKING IT PERSONALLY

Icahn told Reuters on Friday he will personally contribute a couple billion dollars to finance a $5.2 billion bridge loan needed to effect his deal. He added that he had already reached out to several investment bankers. Later, he told CNBC in a TV interview that one of those investment banks included Jefferies.

Icahn and Southeastern said in the letter it was "insulting to shareholders' intelligence for the board to tell them that this board only has the best interests of shareholders at heart. We are often cynical about corporate boards but this Board has brought that cynicism to new heights."

The Icahn and Southeastern challenge comes after Blackstone LP ended its pursuit of Dell in April, pulled out a month after it teamed up with Icahn to challenge the take-private attempt.

Dell said in a statement on Friday that its special committee is reviewing the Southeastern Asset materials and will provide comment in "due course." A representative for Silver Lake declined to comment.

"I don't think Icahn and Southeastern have enough sway over the shareholders," Raymond James analyst Brian Alexander said. "As Dell has a lot of cash, (the latest deal) is basically like a leveraged private equity deal, without the company going private."

Icahn and Southeastern said that, if Dell's board pursues the go-private offer with a shareholder vote, they will put up a slate of 12 directors to challenge the current board. In an interview with CNBC on Friday, the activist investor said Michael Dell will no longer run the company should his slate of candidates be elected.

Both Icahn and Southeastern said they would take additional shares rather than cash. They would finance the proposal from existing cash and about $5.2 billion in new debt.

Icahn and Southeastern together hold about 13 percent of Dell stock. The billionaire investor previously proposed paying $15 per share for 58 percent of Dell.

"As a shareholder, what I'm most pleased about is that the pot continues to be stirred," said Robert Willis, president and CEO of Willis Investment Counsel in Gainesville, Georgia, which owns about 350,000 shares of Dell. "I like the fact that those who oppose this aren't going to lie down."

© Thomson Reuters 2013

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Moto G15 Power

- Moto G15

- Realme 14x 5G

- Poco M7 Pro 5G

- Poco C75 5G

- Vivo Y300 (China)

- HMD Arc

- Lava Blaze Duo 5G

- Asus Zenbook S 14

- MacBook Pro 16-inch (M4 Max, 2024)

- Honor Pad V9

- Tecno Megapad 11

- Redmi Watch 5

- Huawei Watch Ultimate Design

- Sony 65 Inches Ultra HD (4K) LED Smart TV (KD-65X74L)

- TCL 55 Inches Ultra HD (4K) LED Smart TV (55C61B)

- Sony PlayStation 5 Pro

- Sony PlayStation 5 Slim Digital Edition

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IC318DNUHC)

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IA318VKU)