- Home

- Internet

- Internet News

- PayPal now allows Indian merchants to receive up to $10,000 in one transaction

PayPal now allows Indian merchants to receive up to $10,000 in one transaction

By Anupam Saxena | Updated: 29 July 2013 17:03 IST

Click Here to Add Gadgets360 As A Trusted Source

Advertisement

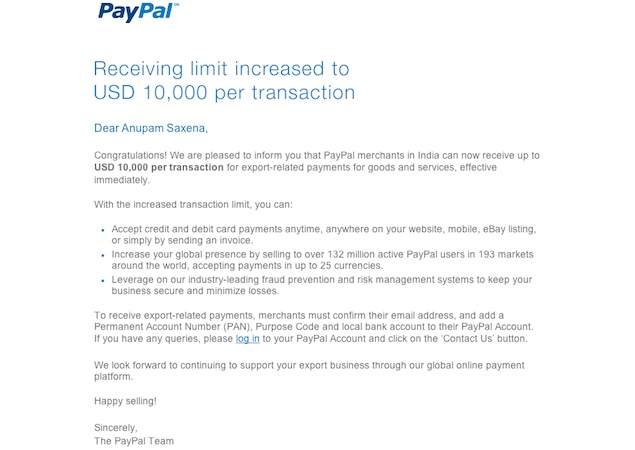

Online payments provider PayPal has increased the per-transaction receiving limit for merchants in India to $10,000.

This essentially means that merchants registered with PayPal will be able to receive up top $10,000 in one transaction for export-related payments for goods and services.

According to an email communication from PayPal, merchants will be able to accept credit and debit card payments on their website, mobile, eBay listing, or by sending an invoice.

However, to be able to receive export-related payments, merchants would need to confirm their email address, and add a Permanent Account Number (PAN), Purpose Code and local bank account to their PayPal Account.

The move comes after the Reserve Bank of India issued a notification allowing Online Payment Gateway Service Providers like PayPal to increase the per transaction receiving limit to $10,000 for export related remittances, as reported by MediaNama.

Previously, the receiving limit per transaction was capped to $3,000 by the RBI. While merchants carrying out transactions through online payment providers will now be able to receive payments of up to $10,000 in one go, it's worth pointing out that these payments will be automatically transferred to their bank accounts as payments are auto withdrawn every day. The steps taken by the Reserve Bank of India are to ensure that these transactions get recorded.

In September 2011, the RBI had capped overseas payments per transaction to $500. The limit was increased to $3000 after just one month.

It was also reported that PayPal had got a license for domestic payments license in India, and could soon start offering domestic payment remittances in the country.

This essentially means that merchants registered with PayPal will be able to receive up top $10,000 in one transaction for export-related payments for goods and services.

According to an email communication from PayPal, merchants will be able to accept credit and debit card payments on their website, mobile, eBay listing, or by sending an invoice.

However, to be able to receive export-related payments, merchants would need to confirm their email address, and add a Permanent Account Number (PAN), Purpose Code and local bank account to their PayPal Account.

The move comes after the Reserve Bank of India issued a notification allowing Online Payment Gateway Service Providers like PayPal to increase the per transaction receiving limit to $10,000 for export related remittances, as reported by MediaNama.

Previously, the receiving limit per transaction was capped to $3,000 by the RBI. While merchants carrying out transactions through online payment providers will now be able to receive payments of up to $10,000 in one go, it's worth pointing out that these payments will be automatically transferred to their bank accounts as payments are auto withdrawn every day. The steps taken by the Reserve Bank of India are to ensure that these transactions get recorded.

In September 2011, the RBI had capped overseas payments per transaction to $500. The limit was increased to $3000 after just one month.

It was also reported that PayPal had got a license for domestic payments license in India, and could soon start offering domestic payment remittances in the country.

Comments

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

Popular on Gadgets

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

Latest Gadgets

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)

© Copyright Red Pixels Ventures Limited 2026. All rights reserved.