- Home

- Internet

- Internet News

- Mobile Payment Platform QuikWallet Secures $1.6 Million in Funding

Mobile Payment Platform QuikWallet Secures $1.6 Million in Funding

Including this round of funding, the venture has raised $2.1 million (roughly Rs. 14 crores) in all so far, and is looking to raise $5 million (roughly Rs. 32 crores) in Series A financing, it said in a statement.

The venture currently caters to about 1,000 restaurants and small merchants with a gross transaction value (GTV) of Rs. 50,00,000 and growing rapidly on a monthly basis.

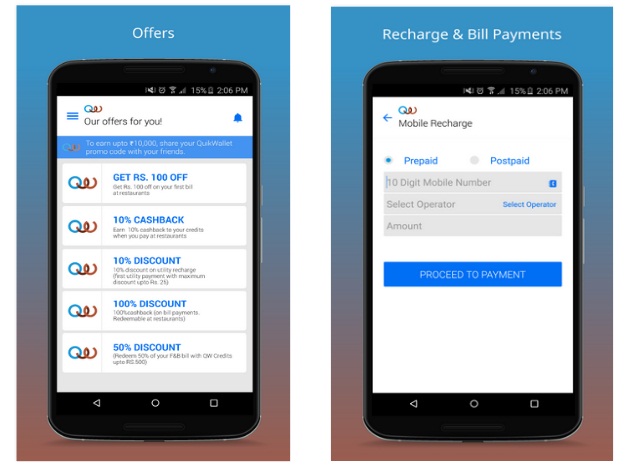

QuikWallet started off as a payments and loyalty app for restaurants and has evolved into a platform that serves diverse merchant categories - from small neighborhood stores, florists, education institutions to car service centres.

The platform provides merchants with options to help collect payments both offline as well as online.

"The line between online and offline is blurring. Banks need to compete with mobile wallets and have to provide a similar solution for their customers. We have now expanded our offerings to customer for both online or offline transactions and we work with banks as issuers on our platform," Mohit Lalvani, co-founder and chief executive, Livquik Technology said.

"Our vision is to bring down the barrier for a merchant to accept payments using just an SMS and NFC tags with no data connectivity or hardware terminals required," he further added.

QuikWallet's merchant connect platform interfaces with its consumer facing app, enabling both businesses and consumers to transact. QuikWallet has the necessary data security certifications in place and recently applied to the Reserve Bank for a semi-closed prepaid payments license, it said.

Get your daily dose of tech news, reviews, and insights, in under 80 characters on Gadgets 360 Turbo. Connect with fellow tech lovers on our Forum. Follow us on X, Facebook, WhatsApp, Threads and Google News for instant updates. Catch all the action on our YouTube channel.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Realme C83 5G

- Nothing Phone 4a Pro

- Infinix Note 60 Ultra

- Nothing Phone 4a

- Honor 600 Lite

- Nubia Neo 5 GT

- Realme Narzo Power 5G

- Vivo X300 FE

- MacBook Neo

- MacBook Pro 16-Inch (M5 Max, 2026)

- Tecno Megapad 2

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Tecno Watch GT 1S

- Huawei Watch GT Runner 2

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)