- Home

- Internet

- Internet Features

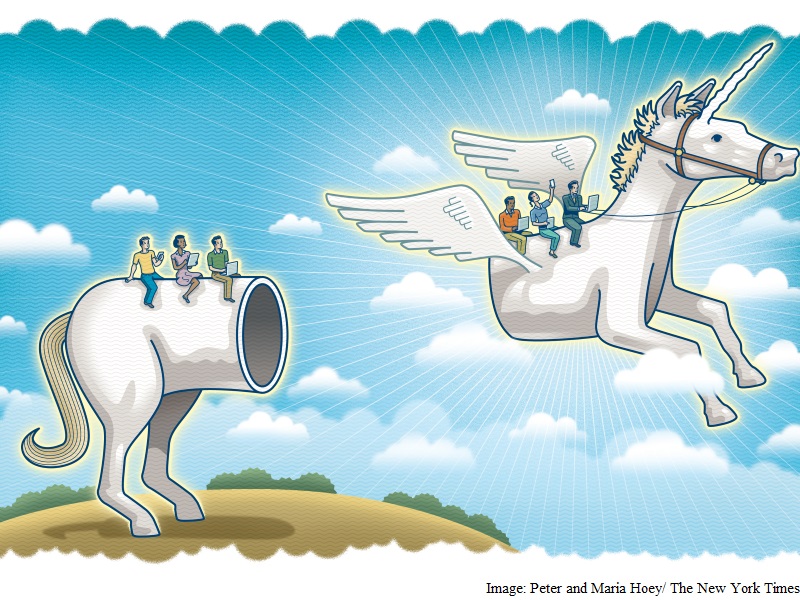

- When a Unicorn Startup Stumbles, Its Employees Get Hurt

When a Unicorn Startup Stumbles, Its Employees Get Hurt

On September 4, employees of Good Technology, a mobile security startup in Sunnyvale, California, awoke to discover that their company was being sold to BlackBerry, the mobile device and software maker.

Some workers immediately began trying to figure out what it meant for Good to abandon its long-anticipated plan to go public - a move that would have potentially turned their shares in the startup into gold. They didn't get firm answers that day, but the prospects did not look great.

Around 9am, hundreds of employees filed into a conference room or started up videoconference software to watch Good's chief executive, Christy Wyatt, discuss the sale. Wyatt introduced BlackBerry's chief, John S. Chen, who winkingly apologized for how his dealmakers had driven Good's sale price down to $425 million (roughly Rs. 2,809 crores), less than half of the company's $1.1 billion (roughly Rs. 7,270 crores) private valuation.

"They're very polite when they're beating you over the head," Wyatt joked in response.

Just how punishing that price was became clear in late September. In an investor document about the sale that was distributed to shareholders, employees discovered their Good stock was valued at 44 cents a share, down from $4.32 (roughly Rs. 485) a year earlier. In contrast, preferred stock owned by Good's venture capitalists was worth almost seven times as much, more than $3 (roughly Rs. 198) a share. The paperwork also showed that Good's board had turned down an $825 million (roughly Rs. 5,453 crores) cash offer just six months earlier, in March.

For some employees, it meant their shares were practically worthless. Even worse, they had paid taxes on the stock based on the higher value.

A few nights after the investor document went around, a glass conference room wall at Good's headquarters was broken, according to an incident report. At a subsequent company meeting, Wyatt told employees that counselors were available to talk to people who needed to vent.

"Many employees may not recover what they've lost," said Matthew Parks, Good's director of cloud products, who has worked at the company since 2006.His Good shares are worth a fraction of the six-figure tax bill he paid for the stock allotted to him before the company was sold.

What Good's employees experienced is an example of who loses out when a company backed by venture capital goes south. While plenty of people - including founders, top executives and investors - are involved in the rise of a startup, those hit the hardest during a company's fall are the rank-and-file employees.

Investors and executives generally get protections in a startup that employees do not. Many investors have preferred stock, a class of shares that can come with a guaranteed payout. Executives frequently get bonuses so they will not leave during deal talks.

In Good's case, the six investors on the board had preferred shares worth a combined $125 million (roughly Rs. 826 crores). After the sale to BlackBerry, Wyatt, who has since left the company, took home $4 million (roughly Rs. 27 crores), as well as a $1.9 million (roughly Rs. 12.5 crores) severance payment, according to investor documents.

In contrast, startup employees generally own common stock, whose payout comes only after those who hold preferred shares get their money. In Good's case, the board's preferred stock was worth almost the same as all 227 million common shares outstanding.

Missing out on the upside of the sale was bad enough, but that wasn't the half of it. Some Good employees actually lost money when BlackBerry bought the company. Good was a unicorn, that is, a private company with a valuation of more than $1 billion (roughly Rs. 6,609 crores). The high valuation increased the paper value of employee shares - and thus the income tax bills levied on their stock when they received the stock grants, or when they bought and sold shares. To pay those taxes, some employees emptied savings accounts and borrowed money.

Some of Good's common shareholders have sued most of the board for a breach of fiduciary duty, asserting that directors looked after the interests of only preferred shareholders.

"It's not unusual for employees to be wiped out while venture capitalists make money," said Dennis J. White, a partner in Boston at the law firm Verrill Dana, who has studied deals like Good's.

Through their lawyers, Wyatt and Good's board declined to comment. BlackBerry also declined to comment.

With the number of unicorn companies estimated at more than 140, the situation of Good's employees may befall other Silicon Valley workers as more startups show signs of wobbling. Many unicorns have raised hundreds of millions - if not billions - of dollars. Most of those dollars must first be repaid to investors and other preferred shareholders before employees see a dime.

The odds that the unicorns will all reap riches if they are sold or go public are slim. Over the past five years, at least 22 companies backed by venture capital sold for the same amount as or less than what they had raised from investors, according to a data company, Mattermark. This means investors did not reap many returns - but there was even less left over for employees. Last year, flash sale company Ideeli was sold to Groupon for $43 million (roughly Rs. 284 crores) after raising $107 million (roughly Rs. 707 crores) from investors. Fisker Automotive, the maker of hybrid electric vehicles, sold for $149 million (roughly Rs. 985 crores) after raising more than $1 billion.

Good Technology in its current form came into being in 2009. That was when mobile software startup Visto bought Motorola's mobile messaging and security business, called Good Technology. The merged company was rebranded Good and eventually shifted its focus to selling mobile security software to big companies and governments.

Wyatt, a former Motorola executive who joined Good in 2013, planned to expand by selling more software to existing customers and to midsize companies. She hired more sales employees and acquired three companies.

In early 2014, Good was valued at more than $1 billion by investors including Draper Fisher Jurvetson and Oak Investment Partners, according to research firm VC Experts. In total, the company raised about $300 million (roughly Rs. 1,982 crores) in equity and debt after Visto bought Good, according to VC Experts.

Good, like most startups, used stock options and equity grants to woo employees. The options allowed employees to purchase stock at low prices, even if the stock had a much higher value. Top sales employees were awarded annual bonuses of 20,000 shares of common stock. When Good purchased startups, those employees got stock as well.

The company, which had about 800 employees, began working on an initial public offering in 2013. It filed to go public in May 2014.

For a while, the dream of employee riches appeared intact. In March, Good executives filmed a video presentation for an investor roadshow for an IPO. The company, whose revenue grew 32 percent to $212 million (roughly Rs. 1,401 crores) in 2014, projected 17 percent revenue growth in 2015. Executives expected Good's cash to last through the year, according to the company's prospectus.

The board and Wyatt appeared so confident that Good would be valued at around $1 billion when it went public that they rejected an $825 million acquisition offer from CA Technologies in March. CA declined to comment.

Yet three days after Good rebuffed CA's bid, bankers recommended that Good delay the IPO for a month. Several tech companies had gone public for less than their private valuations. When the stock of MobileIron, a publicly traded rival, sank in April, bankers recommended that Good further postpone the offering.

At the same time, Wyatt's growth plan wasn't working. Good missed its quarterly forecast for billings, a proxy for new business. Starting in April, the board discussed the "continued strong pressures" on the balance sheet, and management continually lowered financial forecasts, according to investor documents.

Good began discussing options with potential buyers and investors. It got a $650 million (roughly Rs. 4,296 crores) offer from Thoma Bravo, a private equity firm, but did not proceed. Thoma Bravo declined to comment. Good also elicited interest from BlackBerry at an unspecified price, according to investor documents.

Employees were told little about the struggles. At a May company meeting, Wyatt said the company missed financial projections and addressed an email from a competitor that said Good would soon run out of cash, using the risk disclosures in IPO registration documents that addressed Good's spending as proof. In a video of the meeting, she is seen telling employees not to worry. She compared the risk section to "commercials for some new pharmaceutical product and it's like 15 seconds about the product and then there's like 45 seconds of the 15 different ways it can kill you."

At an all-hands company meeting in June, Wyatt again said Good was spending responsibly. Thanks to the cash from a recent $26 million (roughly Rs. 171 crores) legal settlement, she added, the company had "a ton of options," including an IPO, according to a video of the gathering.

"We were under the impression that Good was doing well, that there was nothing wrong with cash flow and that we had a lot of options," said Igor Makarenko, Good's chief information security officer, who has been an employee since 1997.

Companies that buy employee shares offered some Good workers about $3 a share for their stock in the first half of the year. But based on their belief in the company's robust health, the employees refused. Others bought Good common stock in August, when it was valued at $3.34 a share, according to employee tax documents reviewed by The New York Times. Employees had little idea that an outside appraisal firm had valued Good at $434 million (roughly Rs. 2,868 crores) and the common stock at about 88 cents a share as of June 30, according to investor documents and legal filings.

The Internal Revenue Service levied taxes on some employees when their Good stock was still considered a valuable asset and worth multiples of what they actually received. One person's tax bill came to more than $80,000 (roughly Rs. 52,88,000), while another paid more than $150,000 (roughly Rs. 99,00,000), according to interviews with current and former employees, who asked not to be named to protect the privacy of their financial information.

By late July, the board knew that Good would run out of cash in 30 to 60 days, according to investor documents. Good raced to close a deal with BlackBerry, from which it was forced to borrow $40 million (roughly Rs. 264 crores) during the negotiations.

Some employees said they were angry that Wyatt did not stay around after the BlackBerry deal was announced in September. She went on a preplanned trip to China, where she gave advice on staying innovative at a World Economic Forum gathering, and to London for business. She subsequently left Good.

Back in the United States, Good's common shareholders were pushing back. In October, Brian Bogosian, a former Good CEO and a significant shareholder, along with two institutions that own common shares, said the board was not looking after the interests of common stockholders and sued in Delaware Chancery Court. They are seeking unspecified damages and fees.

Randall J. Baron, the lawyer representing Bogosian and the institutions, said that "managers and controlling shareholders may not put their interests ahead of the minority owners of the company."

Good's board wrote in response that the lawsuit was "a case of Monday-morning quarterbacking by former Good insiders with axes to grind and nothing to lose."

Last month, 110 separate common stockholders exercised their right to contest the payout amount. Together, the stockholders own about 32 million of the 75 million common shares that are eligible for that action.

Makarenko and Parks, who remain Good employees, said that they still believed in the company but that their views on management and venture investors have changed. They are among those contesting the payout.

"We listened to these executives and, in the end, incurred huge tax bills because we trusted them," Parks said. "Employees essentially ended up paying to work for the company."

© 2015 New York Times News Service

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Oppo Find X8 Ultra

- Vivo V50e

- Realme Narzo 80x 5G

- Realme Narzo 80 Pro 5G

- OnePlus 13T

- Honor 400 Lite

- Honor Play 60m

- Honor Play 60

- Asus Vivobook 16 (AMD, 2025)

- Asus Zenbook S16 (AMD, 2025)

- Samsung Galaxy Tab S10 FE+

- Samsung Galaxy Tab S10 FE

- Garmin Instinct 3 Solar

- Huawei Watch Fit 3

- Xiaomi X Pro QLED 2025 (43-Inch)

- Xiaomi X Pro QLED 2025 (55-Inch)

- Nintendo Switch 2

- Sony PlayStation 5 Pro

- Whirlpool 1.5 Ton 3 Star Inverter Split AC (SAI18K38DC0)

- Whirlpool 1.5 Ton 5 Star Inverter Split AC (SAI17B54SED0)