This year’s Gartner Hype Cycle showed that the expectations surrounding Artificial Intelligence technologies had peaked, and Machine Learning and Deep Learning would become mainstream in 2 to 5 years. Survey after survey, including one that Infosys commissioned a few months ago, shows widespread acknowledgement of the importance of AI. However, when it comes to their AI vision and the path to it, the enterprises are less sure.

The following checklist might help banks and other organisations begin their journey to AI adoption.

Secure the support of top leadership

Our survey found that the top 3 drivers for AI deployment in enterprises were a quest for competitive advantage, support of executive leadership, and a search for a solution to a business, technical or operational problem. Since these are typically top driven, the bank’s senior management must also be willing to commit the necessary (substantial) resources, and dedicate key personnel to take ownership of the AI agenda. Identifying a passionate owner is key to progress.

Assemble a diversified team

Each bank is different, and will therefore have a different vision of its future with AI. After setting out its vision, the bank will need internal and external teams with a mix of business and technology capabilities to take it forward. An important next step is assessing internal readiness measured by the presence of a strong data analytics foundation, the right technology skills and the success rate in deploying and integrating new technologies.

Pick the AI technologies of interest

AI is not one technology, but many. Machine Learning, Deep Learning, Natural Language Processing, Natural Language Generation, and Visual Recognition are its primary building blocks. Since each technology achieves different things, the bank needs to choose the right ones.

The bank can use machine learning in a very broad range of functions, from customer service to risk management. Deep learning is a subset of machine learning, which uses its artificial neural networks to mimic the human brain to build non-linear analyses. Deep learning also finds wide application in banking. For example, it can prevent fraud by studying behavioural patterns, unearth new business opportunities by identifying consumer preferences based on social media activity, and make better decisions. The applications of natural language processing (NLP) include automatic summarisation and answering, translation, speech or entity recognition, relationship extraction, text mining, and sentiment analysis.

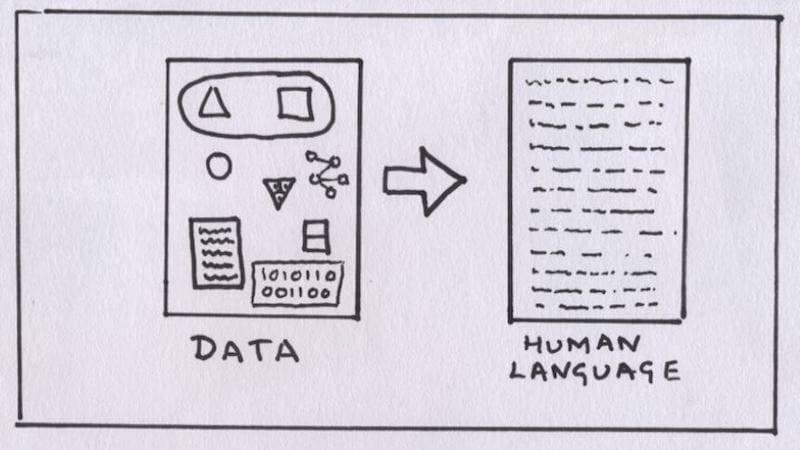

For a bank, one of the most interesting uses of NLP is the chatbot or virtual assistant; several banks are using it for customising content, supporting customers, and resolving queries. Natural language generation technologies are used to combine data from multiple sources and communicating it back to humans in an easy to understand format. Customer/ business user-facing applications are the primary beneficiaries of NLG. Amelia, a cognitive agent, who is transforming the banking experience for customers with her intelligent conversation, is a good example. Banks are leveraging Visual Recognition to reduce friction in user experience.

Westpac, for example, uses it to allow customers to activate a new card, whereas Santander and ABSA Bank are among those using the technology to authenticate documents. A hugely popular service, namely, remote check deposit via mobile, is also based on AR technology.

Once a bank decides which AI technologies to use, it will need to develop the necessary skill sets by training people on the job, or seeking the help of an external partner.

Pick the right use cases

Now the bank must identify the AI business cases it will pursue. It is a good idea to pick those yielding quick wins and testing them internally before taking them public. ICICI Bank is an example of this: it started by automating 200 business processes to gain quick results and now plans to ramp that up to 500.

While a bank may choose to follow some items on this list and ignore the rest, the one thing it cannot do is hang around. An early start on AI will provide valuable competitive advantage and more learning time vis-à-vis the AI systems of other banks. That’s not to be taken lightly.

Mahesh Dutt Kolar is Vice President and Head - APAC, Infosys Finacle. He has more than 20 years of experience in technology and technology-enabled product business.

Infosys Aster, AI-Powered Marketing Suite for Global Enterprises Launched20 June 2024

Infosys Aster, AI-Powered Marketing Suite for Global Enterprises Launched20 June 2024 Infosys Inks AI Deal With Estimated $2 Billion Target Spend Over Five Years: Details18 July 2023

Infosys Inks AI Deal With Estimated $2 Billion Target Spend Over Five Years: Details18 July 2023 Infosys Launches Free AI Certification Training on Springboard Virtual Learning Platform23 June 2023

Infosys Launches Free AI Certification Training on Springboard Virtual Learning Platform23 June 2023 Microsoft, Nandan Nilekani-Backed Indian Group Working on Accessibility-Focused AI Assistant Jugalbandi Bot24 May 2023

Microsoft, Nandan Nilekani-Backed Indian Group Working on Accessibility-Focused AI Assistant Jugalbandi Bot24 May 2023 Infosys Announces Retirement of Kiran Mazumdar-Shaw as Independent Director: All Details23 March 2023

Infosys Announces Retirement of Kiran Mazumdar-Shaw as Independent Director: All Details23 March 2023

![Gadgets 360 With Technical Guruji: Ask TG [ March 22, 2025]](https://c.ndtvimg.com/2024-12/5s52e4k_-ask-tg_640x480_14_December_24.jpg?downsize=180:*)