- Home

- Internet

- Internet Features

- Meet the Startups That are Changing India’s Banking and Financial Institutions

Meet the Startups That are Changing India’s Banking and Financial Institutions

One of the most talked about trends these days is the growth of big data and artificial intelligence. In many cases, the two go hand in hand, and have already made an impact in a number of fields - from medicine and government, to e-commerce and fashion. This is equally true in the BFSI (Banking, Financial Services, and Insurance) space, according to a number of startups that spoke to Gadgets 360 over the last month.

"One of the key changes that has taken place over the last few years is the identifying of data points as a big disruption," said Som Sagar, co-founder at Heckyl, a market analysis platform for investors, traders, and researchers. "Little data points could impact your analysis. For example, SIAM publishes data on cars registered and other data. How would that impact a company? How would a decision by a regulatory body impact the industry? All of this gives us data points, and there is a data explosion right now."

Banking is one of the areas where there's a lot of scope for change, said Ravi Shankar, who has worked in the industry for the last 18 years, and is the founder of Active.ai, a Singapore-based startup with an innovation centre in Bengaluru. The company uses AI to deliver a number of capabilities for banks, bringing in automation, NLP for conversation, and support for IoT.

"We saw a problem in the banking industry. If you want to access a bank, you have to go where the bank asks you to come - branch, call centre, apps," said Shankar. "If you don't have the bank's app, where do you go? But every thing you do in life is messaging, it's the most unstructured way of doing things. Use NLP [natural language processing] and ML [machine learning] to break down the conversation and simplify. Not only do the conversation, but deeply connected the back end."

![]()

Active.ai is working with Axis bank in India, and also banks North America and South East Asia, Shankar told Gadgets 360. "Today, banks are opening up to working with startups for technology, and not just Oracle, or Infosys," he added.

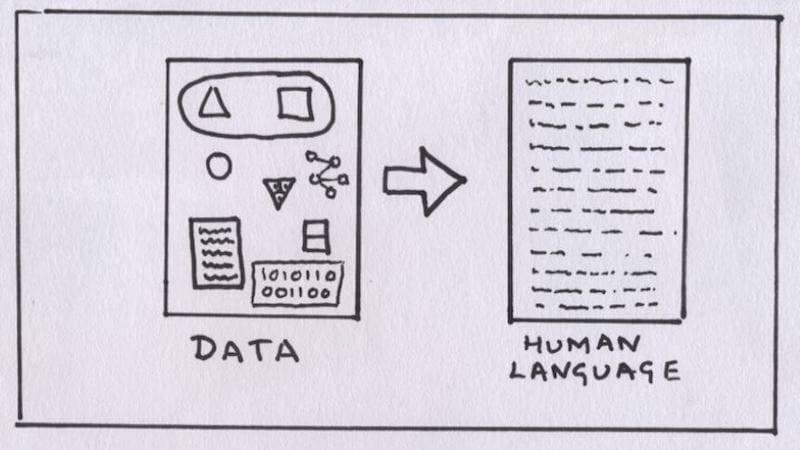

Another AI startup that has been working closely with the BFSI sector is vPhrase, a data insights and visualisation company. Founded by Neerav Parekh, the company works to solve problems with understanding data. "Ideally, the report should tell you what happened, why, and what needs to be done next," he said. "So we're creating reports to draw out the insights, and communicate it in words. We're working with HDFC, Kotak, and a number of others now."

"Banks can use this to send you a statement instead of just a table of data; they can provide a covering letter explaining the data," he added. "This is personalised in local language as well. There are also using this to improve the reports to their own people."

These are some of the ways in which AI-based startups are streamlining processes for banks and other financial companies. The tools that these startups offer can help financial institutions to get up to date, and offer smarter services, with more points of connect for their customers.

Beyond banking insights

But that's not the only way that technology is making a difference in these institutions. Energy management startup Zenatix told Gadgets 360 how it uses IOT technologies to save banks huge amounts of money every month.

![]()

"There are 2.5 lakh ATMs, and 50,000 bank branches around the country. One ATM consumes around Rs. 10,000 worth of energy per month," a spokesperson of the company explained. "So let's say SBI has a Rs. 60 crore electric bill as a line item. We help them to reduce their energy spend across their distributed infrastructure, and predictive maintenance. We help them identify where is the wastage, and how much."

To do this, the company uses a device called the WattMan power manager, which is installed in ATMs. It contains a number of sensors, for temperature, energy use, and so on, uploading data on a connected platform to reduce energy consumption.

"Think of an ATM - they say don't print the receipt and be green," he added. "But they're running three Acs, wasting electricity. We can now intelligently control the device usage via IoT. We can also do ATM maintenance. Many problems can be solved with just a reboot, which we can trigger remotely."

For details of the latest launches and news from Samsung, Xiaomi, Realme, OnePlus, Oppo and other companies at the Mobile World Congress in Barcelona, visit our MWC 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2026

- iPhone 17 Pro Max

- ChatGPT

- iOS 26

- Laptop Under 50000

- Smartwatch Under 10000

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Latest Mobile Phones

- Compare Phones

- Apple iPhone 17e

- AI+ Pulse 2

- Motorola Razr Fold

- Honor Magic V6

- Leica Leitzphone

- Samsung Galaxy S26+

- Samsung Galaxy S26 Ultra

- Samsung Galaxy S26

- Asus TUF Gaming A14 (2026)

- Asus ProArt GoPro Edition

- Apple iPad Air 13-Inch (2026) Wi-Fi + Cellular

- Apple iPad Air 13-Inch (2026) Wi-Fi

- Huawei Watch GT Runner 2

- Amazfit Active 3 Premium

- Xiaomi QLED TV X Pro 75

- Haier H5E Series

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)