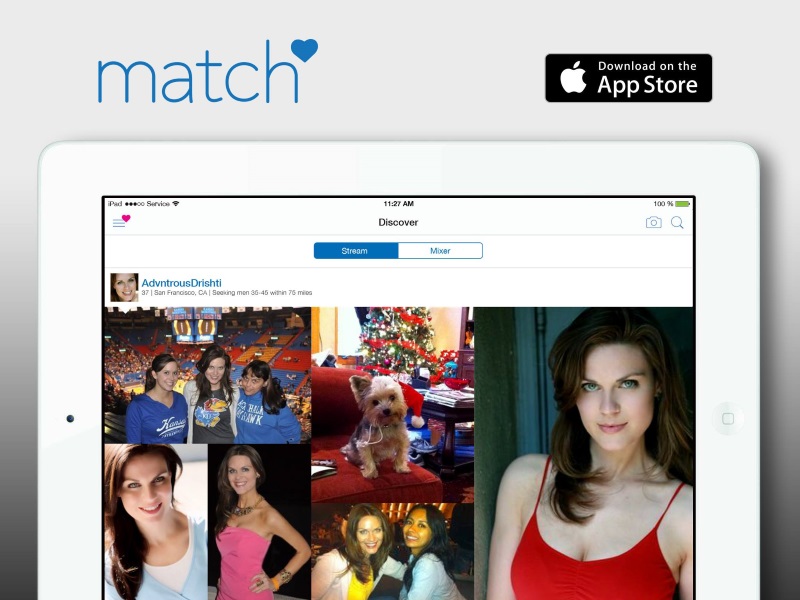

Tinder, Match.com Owner Plans to Raise Up to $466.2 Million From IPO

The owner of Tinder, Match.com and OkCupid hopes to raise as much as $466.2 million (roughly Rs. 3,100 crores) in an initial public offering of company shares.

Match Group Inc. disclosed in a regulatory filing Monday that it will price its IPO of about 33.3 million shares between $12 and $14 (roughly Rs. 800 and Rs. 930) per share.

Match Group will list on Nasdaq under the symbol "MTCH."

There will be three classes of stock: common stock, Class B common stock and Class C common stock. Common stockholders will be entitled to one vote per share, while Class B shareholders will get 10 votes per share. Class C shareholders cannot vote.

Parent company IAC/ InterActiveCorp, controlled by billionaire Barry Diller, will own all shares of outstanding class B stock. It will maintain majority control of Match Group after the offering.

Match operates a portfolio of more than 45 brands, which also include Meetic, Twoo and Friendscout24, each of them designed "to increase our users' likelihood of finding a romantic connection," according to the filing.

Altogether, the company said it offers dating products in 38 languages in 190 countries, with approximately 59 million monthly users total.

In July, Match announced a deal to buy Canadian online dating service PlentyOfFish Media for $575 million (roughly Rs. 3,720 crores).

PlentyOfFish billed itself as an industry leader and expressed confidence that a marriage with Match would accelerate its growth.

Aside from its dating businesses, Match also has a foot in the education space with its ownership of the test preparation and college advising company The Princeton Review.

Written with agency inputs

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Moto G15 Power

- Moto G15

- Realme 14x 5G

- Poco M7 Pro 5G

- Poco C75 5G

- Vivo Y300 (China)

- HMD Arc

- Lava Blaze Duo 5G

- Asus Zenbook S 14

- MacBook Pro 16-inch (M4 Max, 2024)

- Honor Pad V9

- Tecno Megapad 11

- Redmi Watch 5

- Huawei Watch Ultimate Design

- Sony 65 Inches Ultra HD (4K) LED Smart TV (KD-65X74L)

- TCL 55 Inches Ultra HD (4K) LED Smart TV (55C61B)

- Sony PlayStation 5 Pro

- Sony PlayStation 5 Slim Digital Edition

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IC318DNUHC)

- Blue Star 1.5 Ton 3 Star Inverter Split AC (IA318VKU)