Paytm Says May Begin Payments Bank Operations in August

The Noida-headquartered company had received an in-principle approval from RBI to set up a payments bank in August last year.

Payments bank can accept demand deposits and savings bank deposits from individuals and small businesses, up to a maximum of Rs. 1 lakh per account.

"We hope to complete all the requirements and hand them to RBI for their go-ahead by August... by then, we will also have a brick and mortar set-up in place," Paytm co-founder and CEO Vijay Shekhar Sharma told reporters in New Delhi.

However, the focus will be on using technology and connecting the unbanked and underbanked population, he added.

"We will start with north east and central as we mentioned during the licence process," he said.

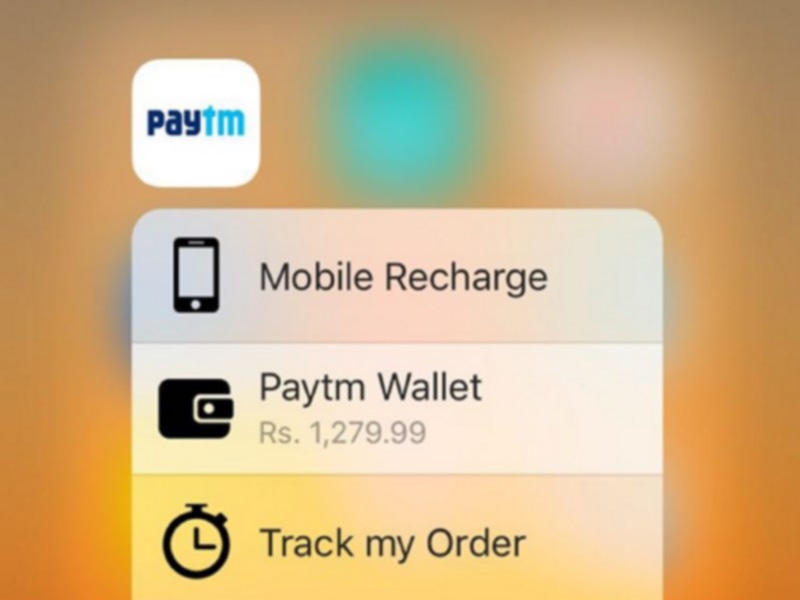

Post the launch of the bank, Paytm will become an end-to-end payment financial services firm with banking and mobile wallet services. It also has an e-commerce platform as well as supports digital payment of recharge and utility bill payment.

"One of the things we are doing is introducing cards with QR codes, which will enable users without smartphones to transact," Sharma said.

According to reports, Paytm has partnered Wipro to create the requisite technology infrastructure for the payments bank business.

Disclosure: Paytm founder Vijay Shekhar Sharma's One97 is an investor in Gadgets 360.

Catch the latest from the Consumer Electronics Show on Gadgets 360, at our CES 2026 hub.

Related Stories

- Samsung Galaxy Unpacked 2025

- ChatGPT

- Redmi Note 14 Pro+

- iPhone 16

- Apple Vision Pro

- Oneplus 12

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Tecno Spark Go 3

- iQOO Z11 Turbo

- OPPO A6c

- Samsung Galaxy A07 5G

- Vivo Y500i

- OnePlus Turbo 6V

- OnePlus Turbo 6

- Itel Zeno 20 Max

- Lenovo Yoga Slim 7x (2025)

- Lenovo Yoga Slim 7a

- Lenovo Idea Tab Plus

- Realme Pad 3

- Garmin Quatix 8 Pro

- NoiseFit Pro 6R

- Haier H5E Series

- Acerpure Nitro Z Series 100-inch QLED TV

- Asus ROG Ally

- Nintendo Switch Lite

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAID5BN-INV)

- Haier 1.6 Ton 5 Star Inverter Split AC (HSU19G-MZAIM5BN-INV)