Facebook Inc will buy fast-growing mobile-messaging startup

WhatsApp for $19 billion in cash and stock in a landmark deal that

places the world's largest social network closer to the heart of mobile

communications and may bring younger users into the fold.

The

transaction involves $4 billion in cash, $12 billion in stock and $3

billion in restricted stock that vests over several years. The WhatsApp

deal is worth more than Facebook raised in its own IPO and underscores

the social network's determination to win the market for messaging.

Founded

by a Ukrainian immigrant who dropped out of college, Jan Koum, and a

Stanford alumnus, Brian Acton, WhatsApp is a Silicon Valley startup

fairy tale, rocketing to 450 million users in five years and adding

another million daily.

"No one in the history of the world has

ever done something like this," Facebook Chief Executive Mark Zuckerberg

said on a conference call on Wednesday.

Zuckerberg, who famously

closed a $1 billion deal to buy photo-sharing service Instagram over a

weekend in mid-2012, revealed on Wednesday that he proposed the tie-up

over dinner with CEO Koum just 10 days earlier, on the night of February

9.

WhatsApp was the leader among a wave of smartphone-based

messaging apps that are now sweeping across North America, Asia and

Europe. Although WhatsApp has adhered strictly to its core functionality

of mimicking texting, other apps, such as Line in Japan or Tencent

Holdings Ltd's WeChat, offer games or even e-commerce on

top of their popular messaging features.

The deal provides

Facebook entree to new users, including teens who eschew the mainstream

social networks but prefer WhatsApp and rivals, which have exploded in

size as private messaging takes off.

"People are calling them 'Facebook Nevers,'" said Jeremy Liew, a partner at Lightspeed and an early investor in Snapchat.

How the service will pay for itself is not yet clear.

Zuckerberg

and Koum on the conference call did not say how the company would make

money beyond a $1 annual fee, which is not charged for the first year.

"The right strategy is to continue to focus on growth and product,"

Zuckerberg said.

Zuckerberg and Koum said that WhatsApp will

continue to operate independently, and promised to continue its policy

of no advertising.

"Communication is the one thing that you have

to use daily, and it has a strong network effect," said Jonathan Teo, an

early investor in Snapchat, another red-hot messaging company that

flirted year ago with a multibillion dollar acquisition offer from

Facebook.

"Facebook is more about content and has not yet fully figured out communication."

Price tag

Even so, many balked at the price tag.

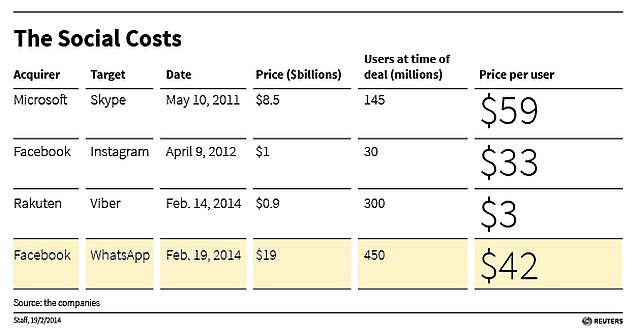

Facebook

is paying $42 per user with the deal, dwarfing its own $33 per user

cost of acquiring Instagram. By comparison, Japanese e-commerce giant

Rakuten just bought messaging service Viber for $3 per user, in a $900

million deal.

Rick Summer, an analyst with Morningstar, warned

that while investors may welcome the addition of such a high-growth

asset, it may point to an inherent weakness in the social networking

company that has seen growth slow in recent quarters.

"This is a

tacit admission that Facebook can't do things that other networks are

doing," he said, pointing to the fact that Facebook had photo-sharing

and messaging before it bought Instagram and WhatsApp.

"They can't

replicate what other companies are doing so they go out and buy them.

That's not all together encouraging necessarily and I think deals like

these won't be the last one and that is something for investors to

consider."

Venture capitalist Sequoia Capital, which invested in

WhatsApp in February 2011 and led three rounds of financing altogether,

holds a stake worth roughly $3 billion of the $19 billion valuation,

according to people familiar with the matter.

"Goodness gracious, it's a good deal for WhatsApp," said Teo, the early investor in Snapchat.

Facebook pledged a break-up fee of $1 billion in cash and $1 billion in stock if the deal falls through.

Facebook was advised by Allen & Co, while WhatsApp has enlisted Morgan Stanley for the deal.

Shares in Facebook slid 2.5 percent to $66.36 after hours, from a close of $68.06 on the Nasdaq.

"No

matter how you look at it this is an expensive deal and a very big bet

and very big bets either work out or they perform quite poorly," Summer

said. "Given the relative size, the enterprise valuations this is a very

significant deal and it may not be the last one."

© Thomson Reuters 2014

Getty Images to Acquire Shutterstock to Create $3.7 Billion Firm8 January 2025

Getty Images to Acquire Shutterstock to Create $3.7 Billion Firm8 January 2025 Crypto Brokerage FalconX Buys Derivatives Startup Arbelos Markets3 January 2025

Crypto Brokerage FalconX Buys Derivatives Startup Arbelos Markets3 January 2025 Nvidia Closes Acquisition of Israeli Software Startup Run:ai31 December 2024

Nvidia Closes Acquisition of Israeli Software Startup Run:ai31 December 2024 Microsoft’s Gaming Chief Phil Spencer Is Still Open to Acquisitions After Activision Deal14 November 2024

Microsoft’s Gaming Chief Phil Spencer Is Still Open to Acquisitions After Activision Deal14 November 2024 Zomato to Acquire Paytm's Entertainment Ticketing Business for $244.2 Million22 August 2024

Zomato to Acquire Paytm's Entertainment Ticketing Business for $244.2 Million22 August 2024

![Gadgets 360 With Technical Guruji: Ask TG [ March 22, 2025]](https://c.ndtvimg.com/2024-12/5s52e4k_-ask-tg_640x480_14_December_24.jpg?downsize=180:*)