If tech companies are to be believed, the greatest inconvenience in

life these days is taking our wallets out to pay cash. While we

certainly agree that handing over money is a thoroughly unpleasant

experience, the growing wave of interest in cashless transactions could

bring a new set of problems along the way.

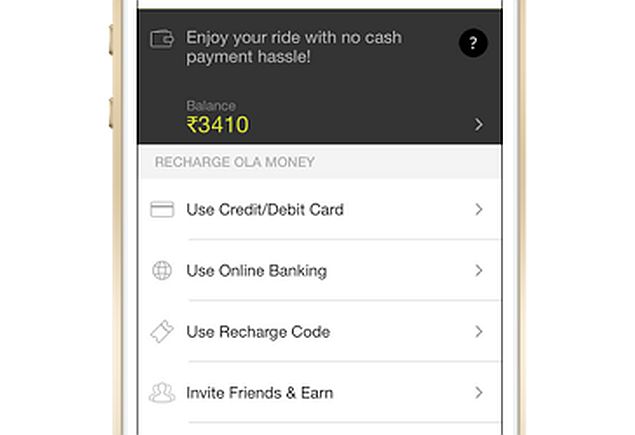

Last week, Ola cabs, a

popular radio cabs service, announced its prepaid wallet and a day after

Ola's competitor Meru followed up by announcing Cab Wallet. With both

these systems, you load the wallet in advance with money, and your cab

fare is automatically deducted at the end of the journey so you don't

need to worry about carrying cash or entering your credit card's

verification code.

Deepinder Goyal, CEO of Zomato, a popular restaurant

listing site, recently told NDTV Gadgets that the company is working on a system of cashless payments which will

be implemented in the next couple of months.

This isn't a

development that's only taking place in India either. Companies like

Apple and Google have also been working on cashless payments for a long

time now. At the launch of the iPhone 6 and iPhone 6 Plus, the company also showcased a new system called Apple Pay for cashless transactions.

The difference is that these systems still use your credit card for payment instead of holding your cash. Globally, PayPal is perhaps the most popular example of a wallet, though the service has since grown to become a lot more. In China, Alibaba's Alipay is another popular virtual wallet, which became popular thanks to its escrow model, where the payment is not released to the seller until the buyer indicates they are happy with the transaction. Alipay reportedly has over 300 million users, controlling over half the online payment market in China.

Like a 'real' wallet, a virtual wallet is a storage place for your money. You can use your credit or debit card to let the wallet hold your money in escrow, from

where you can make payments to different services. Your credit or debit card is only used to load the prepaid balance, and not afterwards.

In India the

advantage of a mobile wallet is that it can bypass the two-factor

authentication at the time of making a transaction. If you're shopping

online and you try to make a payment with your card, you need to enter a

password or a one-time password that is sent over SMS, even if you've

saved the card details with the seller. This slows down the payment

process significantly and typing this in on a phone is quite

inconvenient.

Even with a physical terminal, you need to enter your

4-digit PIN to verify the payment. In contrast, a mobile wallet is a

frictionless experience when you are completing the purchase, though loading up the wallet via your credit or debit card still is a

two-step process.

Mobile wallets are not a new idea, of course.

Carriers like Vodafone and Airtel have been building m-Paisa and Airtel

Money respectively, and companies like Freecharge, Paytm and Oxigen

Wallet are all growing in this space.

Zomato's Goyal told us that

when payments are added to the app users will be able to buy prepaid

balance with Zomato, which can then be used to pay for food from

restaurants through the app. Ola cabs' Director - Marketing Communications Anand Subramanian says the company has built a standalone

wallet which can only be used to pay for Ola cabs rides.

"Cash is

still the largest and most preferred mode of payment among our

customers," said Subramanian. "But at the end of each ride there are

hassles with change, and all of that gets totally sorted [with a mobile

wallet]. It also becomes possible to pay for other peoples' rides. You

can book a ride for your family from the Web, so the payment gets

deducted from your account."

The catch is that while Subramanian

uses the term mobile wallet, the functionality that Ola cabs has built

is properly described as a closed wallet. Not only are you parking your

money with Ola cabs - losing the interest it would make in your bank

account - but you can't withdraw this money back to your account or use

it to pay for anything other than a ride with Ola cabs.

That

means that you have to get one wallet for Ola cabs, and then another

wallet to pay your restaurant bills with Zomato. This is not a problem

if there are just a couple of services and/ or if you're completely

loyal to one provider. Say, however, if one day no Ola cabs are

available at your location and you need to call Uber, or the restaurant

you wish to order from is on Foodpanda and not Zomato, then your fat wallet

balance is useless. And as more services go online, the problems start

to multiply.

Amit Lakhotia, Vice President - Business at Paytm

said that this problem is exactly why unified wallets like Paytm are

required. Paytm, which is in talks with Ola at the moment, also works

with services such as TastyKhana and JustEat for cashless payments.

"Imagine

if you have to keep Rs. 1,000 with Ola, Rs. 1,000 with TaxiforSure, Rs.

2,000 for Meru, and then Rs. 500 with Paytm and Rs. 500 for

Freecharge," said Lakhotia. "Tracking your money becomes impossible and

the convenience of a wallet goes away."

"And these are closed

wallets, which are only useful with a single vendor, so they can't

become more useful," he said. "In a semi-closed wallet, you can put

money in, use it at different vendors, and move your money back to the

bank to withdraw it as cash. You can only use a closed wallet with one

vendor."

Setting up a closed wallet is much simpler than a semi-closed wallet, in terms of regulations.

"If

you wanted to, NDTV could make a closed wallet in days," Lakhotia said.

A semi-closed wallet, however, involves RBI oversight, and a much

greater degree of regulation.

"We are open to integrations over

time, but I don't want a user on the Ola platform to go and take the

hassle of signing up for another platform," said Subramanian. "We have

kept the wallet super simple, and kept all the control with the

customer. You know how much you use the cab on a monthly basis. If it's

mixed with your other payments, it can become harder to manage."

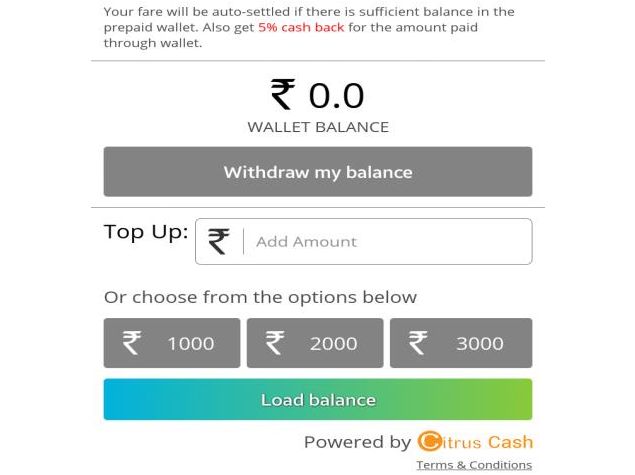

In

contrast, Meru has tied up with Citrus Pay, a full online wallet with

RBI approval. Instead of asking you to download the Citrus app and use

that to manage your cash, Meru embedded the feature in its app, and if a

customer uses the Cab Wallet, a Citrus account is created for them.

You

can send money to your wallet using your credit or debit card or

netbanking, and this money is also accessible using the Citrus app.

Similarly, if you have an account with Citrus, you can sign into it from

the Meru app and access those funds. This is a more convenient

approach, because you can use Citrus Pay with other vendors, such as

Lenskart and Zivame.

"Roughly 17 percent of all transactions take

place with a [credit or debit] card," said Siddhartha Pahwa, CEO Meru.

"The problem is that when you make a payment, it must be relayed to the

bank, and the authorisation has to be verified by Visa, so it's a very

long loop." This caused card transactions to fail too often to be a

convenient option, he said, and the Cab Wallet circumvents this problem.

According to Pahwa, the decision to partner instead of building its own service

was because Meru did not want to get involved in building out an entire

payments business.

"We [Ola] didn't want to limit the wallet to just

paying for cabs - that's just a prepaid card," said Subramanian. "This is

completely seamless; there is no problem of trying to pay Rs. 250 for a

Rs. 227 fare and finding that no one has change."

While

convenience is a big draw - both Ola cabs and Meru say that response to

beta tests was extremely positive - the companies recognise that people

here are not too familiar with the idea of mobile wallets as yet. That's

why both of them are offering incentives to users who opt for the

wallets instead of cash.

For the entire month of October, any

money credited to the Ola cabs wallet will be matched by the company -

effectively giving you a 50 percent discount on all taxi rides, though

your money stays.

"You can put anything between Rs. 100 and Rs. 5,000 in the wallet, and we'll double it," said Subramanian.

That

upper limit is because a mobile wallet is allowed a maximum value of

Rs. 10,000 by the RBI as a security measure. As a closed wallet, Ola

can't refund your money, but Subramanian says there is no expiry date

for funds placed in the wallet, so they can be used at any point.

Till

the end of this year Meru will also offer a five percent cashback on

all fares paid using the wallet, which can be used to later pay any of

the vendors that support Citrus Pay.

While these are interesting

developments, we have still not reached a stage where you can do away

with cash entirely. Until there is a centralised system that is as

universally accepted as a credit card (at least), payments will be

fragmented between various providers, and solving this problem is going

to be the most important factor in building a cashless society.

Given

that it is relatively simple to build a closed wallet, we're most

probably going to see more companies take this route to quickly simplify

their recurring payments - in other words, expect fragmentation to get

much worse at least in the near term. Over time though, there are a couple of different ways in

which things could get better - consolidation could lead to only a few

players emerging as the dominant option (much like we've seen in the

e-commerce market) or government intervention could lead to

interoperability between systems.

Looking at the market right now

though, things will likely get a lot more confusing, before clarity starts to emerge.

Threads Reportedly Testing New Feature for Importing Social Graph, Finding Creators Followed on X11 April 2025

Threads Reportedly Testing New Feature for Importing Social Graph, Finding Creators Followed on X11 April 2025 Aadhaar App With Facial Recognition-Based Authentication Unveiled by UIDAI9 April 2025

Aadhaar App With Facial Recognition-Based Authentication Unveiled by UIDAI9 April 2025 Instagram is Finally Developing a Dedicated iPad App to Boost App Usage: Report9 April 2025

Instagram is Finally Developing a Dedicated iPad App to Boost App Usage: Report9 April 2025 Google NotebookLM App Is Coming Soon, Company Confirms8 April 2025

Google NotebookLM App Is Coming Soon, Company Confirms8 April 2025 iOS 19 Design Leak Hints at 'Floating' Tab View, New Icon Shapes and More8 April 2025

iOS 19 Design Leak Hints at 'Floating' Tab View, New Icon Shapes and More8 April 2025

![Gadgets 360 With Technical Guruji: News of the Week [April 12, 2024]](https://c.ndtvimg.com/2025-04/jlpk5kco_news-of-the-week_160x120_12_April_25.jpg?downsize=180:*)